Jul 03, 2023 By Susan Kelly

If you're a veteran or active-duty service member considering buying a home, utilizing your VA Loan benefits is an excellent way to finance a purchase. One important requirement for the successful use of your VA loan is pre approval.

With pre-approval, buyers can rest assured that the lender will approve their loan as they explore different properties and work toward closing on the perfect piece of real estate. In this blog post, we'll dive deep into what you need to know about getting VA Loan preapproval and how it can benefit you when you make the big move toward homeownership.

Basics of VA Loans and Eligibility Requirements

Before you can apply for a VA loan, it's important to understand this program's basics and ensure you meet all requirements. VA loans are home loans offered to veterans or active-duty military members. Eligibility requirements include:

- Being in service for 90 straight days, or 181 straight days, during a war.

- Peacetime, or 6 years in the reserves/National Guard.

- Having an honorable discharge from service.

- Meeting income and credit score requirements.

- Occupying the property purchased as your primary residence.

Learn the preapproval process for VA loans

Once you've determined your eligibility, it's time to begin the pre-approval process. To get VA loan preapproval, you'll need to provide documentation such as the following:

Proof of identity (driver's license or state ID).

- Income verification (most recent two years' tax returns).

- Bank account and investment statements to verify funds available for a down payment.

- A Certificate of Eligibility from the Department of Veterans Affairs.

During this process, your lender will also run a credit check to verify your score is high enough to qualify for the loan. Having a good credit score and ensuring all your debts are paid on time is beneficial.

How to Get Pre-Approved

It's always a good idea to shop around for VA loan preapproval. Different lenders may offer different rates and conditions, so it pays to compare offers. Some lenders may even have expedited processes that can store the pre-approval process.

It's also important to note that VA Loan Preapproval differs from lender's prequalification letter. A pre-qualification is just an estimate of what you could expect regarding your loan amount, but it must assure you that the lender will approve your application when you apply.

Benefits of Getting VA Loan Preapprovals

- Customers gain assurance that their VA Loans will be approved when they apply.

- Preapprovals can give buyers the confidence to make competitive offers on a home they love.

- Most lenders provide preapproved customers with a maximum loan amount they are eligible for.

- A pre-approval letter makes shopping for the best rates and conditions from different lenders easy.

- Pre-approved customers may be able to close faster than non-pre approved buyers.

- Obtaining a preapproval certificate could mean lower interest rates in some cases.

- With an agreed-upon loan amount, the underwriting process may go more smoothly and quickly.

- VA Loan preapproval often means less paperwork for borrowers to worry about.

Getting VA Loan preapproval is an important step in the home-buying process. By understanding how to get VA loan preapproval, you can ensure eligibility and take advantage of this program's benefits. With a little extra effort upfront, you can be on your way toward owning your dream home sooner than you think.

Drawbacks of Getting VA Loan Preapprovals

Although there are many advantages to getting VA loan preapproval, some drawbacks should be considered. Preapproved customers may face stricter requirements and more paperwork regarding the loan application process.

Lenders who provide preapprovals often require extra documentation from their applicants to verify that all information is accurate and up-to-date. Borrowers who obtain preapproval may find themselves in a less flexible position when negotiating terms with their lender.

As such, they may need help to take advantage of lower interest rates or other incentives that may become available after the initial pre-approval. Although having a preapproved loan amount can make shopping for homes easier, it's important to note that this amount is not guaranteed.

The final loan amount provided may differ from the preapproved amount based on various factors, including changes in credit score, income, and other financial circumstances. For these reasons, it's important to ensure you are comfortable with all terms and conditions of the VA Loan before taking out a preapproval.

Overall, obtaining VA loan preapproval can greatly benefit borrowers who wish to take advantage of their VA benefits. By understanding the process and being aware of potential drawbacks, you can be sure to make an informed decision when it comes to finding the perfect home for your needs.

Find the right lender for your needs

Once you meet eligibility requirements, it's time to start shopping around for lenders. Different lenders have different rates and conditions, so comparing offers from a few is important. Consider the fees associated with the loan and any additional services you may need during the loan process.

- Gather all your financial documents, such as income statements, tax returns, bank statements, etc.

- Talk to a real estate agent and find a lender specializing in VA loans.

- Apply for preapproval with your chosen lender and submit the required paperwork.

- Check your credit score to ensure it meets the VA's requirements.

- Please wait for the lender's response and review their offer before deciding on a loan package.

- Once your loan is preapproved, you can start shopping for and closing on a home.

By taking all the right steps to get VA Loan preapproval, veterans and active-duty service members can ensure they are in the best possible position when it comes time to purchase their dream home. With a proper preapproval certificate, buyers can shop around confidently for their perfect house with peace of mind that their loan will be approved once they've found it.

FAQS

Can you get a preapproval letter?

Yes, you can. A pre-approval letter is a lender's official commitment to giving you a loan based on the financial information you provide during the preapproval process. This letter will include details such as the maximum loan amount you are eligible for and any conditions that must be met before your loan is approved. It also serves as an important tool when negotiating with sellers, assuring them that you are a serious buyer.

Are pre approvals binding?

No, they are not. Preapprovals are not legally binding, and the actual loan amount you receive may differ from what is stated in your preapproval letter. Lenders may require additional documentation or verify information provided during the preapproval process, which could affect the loan amount or terms.

Can I get a preapproved letter without a hard inquiry?

Yes, getting a preapproval letter without a hard inquiry. It is typically possible. Your lender may be able to pull your credit report with a soft pull that does not affect your score. This will allow them to make an informed decision about your loan eligibility without incurring additional costs or damaging your credit score.

Conclusion

Getting a VA loan preapproval is a great way to ensure you get the house of your dreams. Now that you know how to get VA loan preapproval, you can begin the process as soon as possible! Begin by gathering financial documents and contacting a VA lender.

Take advantage of current mortgage rates and review all program guidelines before making home offers. Be sure to look into any state grants or home assistance programs available where you are also looking to purchase. With this information and knowledge of the VA loan program, you will be ready to take the next step toward achieving homeownership with productive success.

-

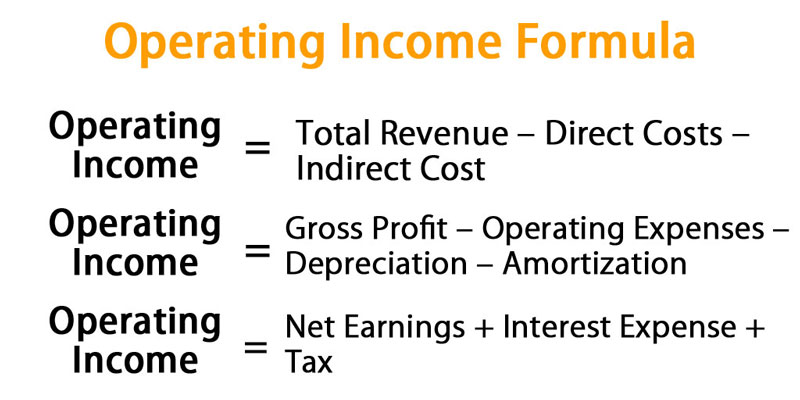

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

CFA vs. CFP: Which Is Better For You?

Jun 07, 2023

-

Various forms of algorithm contracts

Oct 05, 2021

-

How Do I Remove PMI On My Conventional Loan?

Jul 03, 2023

-

All About Chargeback?

Aug 08, 2022

-

Our Cash Offers More Advantageous to Sellers?

Mar 17, 2022

-

Everything You Need to Learn About the Best Personal Finance Courses

Jul 13, 2022

-

How Do Unsecured Loans Work?

Aug 26, 2022