Jun 07, 2023 By Triston Martin

A person must first finish a required course of study and pass a two-part test before becoming a Certified Financial Planner®. The test covers various fundamental aspects of personal finance, including estate planning, retirement planning, tax planning, insurance, and asset management. You must pay attention to each area to assist customers in accomplishing their financial objectives.

CFA Stands For "Chartered Financial Analyst."

On the other hand, a CFA is an investor who works in bigger settings, typically for large investment companies on both the buy side & the sell side, as well as for mutual funds and hedge funds. Certified Financial Analysts (CFAs) are qualified to provide internal financial analysis for businesses not involved in the investment industry. A Certified Financial Planner (CFP®) is an expert in wealth planning and management for individual customers, whereas a Certified Financial Analyst (CFA) is an expert in wealth management for corporations.

A candidate for the Chartered Financial Analyst (CFA) designation must complete a demanding course of study and three exams spread out over at least two years. In addition, the candidate must abide by a stringent code of ethics and have at least four years of experience working in an environment that involves investment decision-making.

CFA Versus CFP: What is The Difference?

There are significant distinctions between the CFA & CFP, even though both involve extensive study and testing:

The CFP is geared at all aspects of financial planning, whereas the CFA emphasizes investment management.

Quantitative techniques, economics, financial reporting & analysis, corporate finance, and advanced stock investment strategies are all tested on the CFA exam. The Certified Financial Planner test topics include budgeting, saving, investing, insurance, retirement, and estate planning. Both of these cultures value ethics highly.

While CFAs are more likely to work in large organizations conducting research or analysis, CFPs focus on individual customers and their financial objectives. However, "many CFPs do an excellent job developing and overseeing investment portfolios for the clients," adds Leaman, while many CFAs regularly visit clients and work on their plans.

Financial planners (CFPs) focus on long-term customer planning, whereas chartered financial analysts (CFAs) engage in the day-to-day trading of assets, including commodities, currencies, and derivatives.

Certified Financial Planners, according to Leaman, "benefit from strong people skills & the ability to know somewhat about a lot of topics." Those who aim for the CFA designation are more analytical and numerate.

According to Leaman, "CFAs all think - probably correctly - that they're smarter than everyone else." This may be the simplest way to comprehend the distinction between CFAs and CFPs. All CFPs believe (perhaps accurately) that they are the industry's most caring and customer-centric professionals. All these aspects are important for investors to consider when choosing a financial advisor. Thus, "clients aren't really able to go wrong either way," he concludes.

What's Better For You: The CFA Or The CFP?

Simply put, the Certified Financial Planner (CFP) credential is more narrowly focused on jobs in personal financial planning & asset management. At the same time, the Chartered Financial Analyst (CFA) certificate is wider in its focus.

The CFA designation makes available opportunities in research analysis, investing, corporate finance, and portfolio management. In contrast, those in wealth management, financial planning for individuals, and consulting are made available by the CFP designation.

Both the CFP and the CFA are highly respected credentials that may help you advance your career anywhere in the world. Many financial sector workers get both certifications to further their careers.

It all depends on what kind of job you want to do:

CFP is the best option if you want to go into financial planning.

If you aren't 100% committed to a career in finance but are still interested in the field, earning your CFA designation may provide you with the breadth of knowledge you need to make an informed decision.

Bottom Line

There is a broad consensus that financial counsellors should hold either the CFA or the CFP. Clients may be okay dealing with an advisor who needs both credentials. Both certifications provide training in planning for one's financial security. It is important to know what you want to specialize in if you are thinking about a career in finance & want to add a certification to your CV. While CFPs focus on financial planning for individuals, CFAs work in financial analytics and investment. Remember that earning a CFA takes time and requires additional testing.

-

What Is ROI On Real Estate Investments

Jun 14, 2023

-

Depository Trust Company

Aug 16, 2022

-

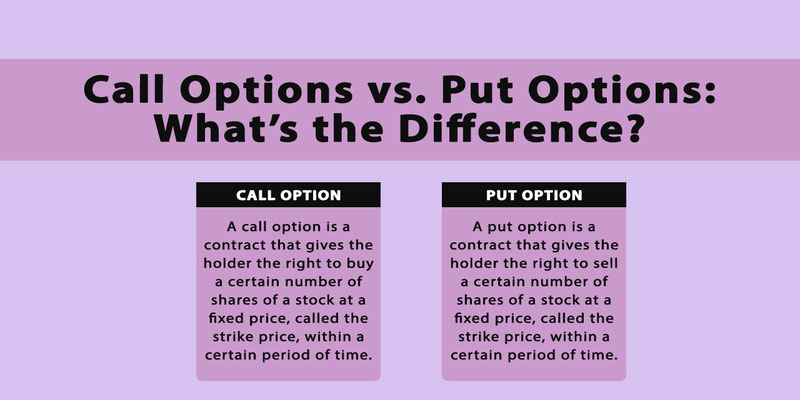

What is the Difference Between Call Option vs. Put Option

Jun 03, 2023

-

Our Cash Offers More Advantageous to Sellers?

Mar 17, 2022

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022

-

Bank Of America Customized Cash Reward Credit Card Review In Detail

Jul 19, 2022

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

A Quick Shot: What Is an Alien Insurer?

Aug 08, 2022