Jun 03, 2023 By Triston Martin

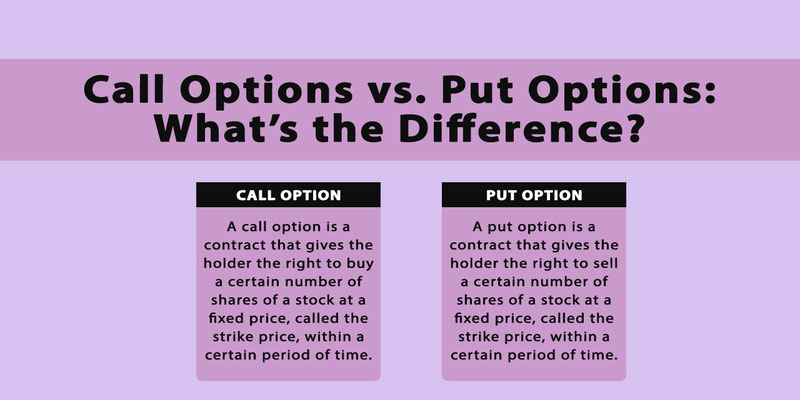

Both call options and put options are derivative in the financial markets. Investors can gain exposure to the performance of demand for stocks, commodities, or currencies without physically possessing those assets. The buyer of a call option must purchase the underlying asset at the option's strike price and within the option's time frame but has no other responsibility to do so. When buyers anticipate a rise in the asset's price, they are more likely to invest in call options. A buyer can profit by exercising a call option to purchase an item at a lower price if the price rises. The purchaser of a put option acquires the right but not the duty to sell the underlying asset to the option's seller at an agreed-upon price and within a specific time frame. Put options are purchased when a buyer believes the underlying asset's value will fall.

Call Option

Until the option's expiration date, the holder of a call option has the right to purchase the underlying asset at the option's strike price. A call option is purchased when one anticipates that the underlying asset's price will increase and wants to profit from this increase. Essential features of call choices are:

Buyer's Perspective

The buyer of a call option agrees to pay the option's writer a premium in exchange for the right to acquire the underlying asset. If the asset's price is lower than the strike price at expiration, the buyer might choose not to execute the option and bear only the premium cost.

Seller's Perspective

The premium paid by the buyer of a call option is the consideration for the seller's promise to sell the underlying asset in the event of the option's execution. Since the asset's price can increase substantially, the seller's risk is theoretically unlimited.

Profit Potential

Buyers of call options stand to gain in one of two ways: either by exercising their options and purchasing the underlying asset at a discount to the market price or by selling their options to another investor for a premium above the amount they initially paid for the options. The profit potential is infinite because the underlying asset's price might rise indefinitely.

Break Even Point

The moment a call option buyer breaks even is the sum of the strike price and the premium. The underlying asset's price must rise above this point for the buyer to make money if they decide to exercise the vote.

Expiration

There is a time limit on the validity of a call option. If the underlying asset's price is lower than the strike price at expiration, the buyer of the option can decide not to exercise it and forfeit the premium paid.

Put Option

The holder of a put option has the right, up to the option's expiration, to sell the underlying asset at the strike price. Put options are commonly employed to protect against, or speculate on, a drop in the underlying asset's value. Essential features of put options are:

Buyer's Perspective

A put option is a financial contract in which the buyer pays the seller a premium for the right to sell the underlying asset. The purchaser anticipates a decline in the asset's price, allowing them to resell the item at a premium to the current market price. The amount of the compensation is all that the buyer has to lose.

Seller's Perspective

In exchange for the premium paid by the buyer, the seller of a put option agrees to purchase the underlying asset if the buyer exercises the option. If the asset's price decreases sufficiently, the seller may incur losses if it needs to buy the support at the strike price.

Profit Potential

If the underlying asset's price falls below the put option's strike price, the option's buyer may profit by either taking the option or trading it at a better price. The profit potential is limited to the greater of the opportunity premium (if any) or the spread (if any) between the asset's price and the strike price.

Break Even Point

If you buy a call option, your breakeven point is the strike price plus the premium, while if you buy a put option, it's the strike price minus the bonus. The buyer incurs no additional cost or benefit by exercising the opportunity at this time.

Conclusion

Both call options and put options are valuable instruments in the trading and investment of financial markets. Investors can get exposure to price increases by purchasing call options, while those who anticipate a decrease in value can hedge their bets by purchasing put options. Investors can better manage risk and improve their investment strategy by learning the rights and responsibilities associated with the call-and-put options. Options allow you to adapt to market fluctuations and the profit potential regardless of whether you're using them for hedging, speculating, or income generation.

-

How to Get VA Loan Preapproval

Jul 03, 2023

-

Ways to Open a Savings Account

Feb 20, 2023

-

What is a Closing Disclosure

Jul 04, 2023

-

How Do Unsecured Loans Work?

Aug 26, 2022

-

Tennessee Housing Development Agency Lenders

Jan 13, 2023

-

A Quick Shot: What Is an Alien Insurer?

Aug 08, 2022

-

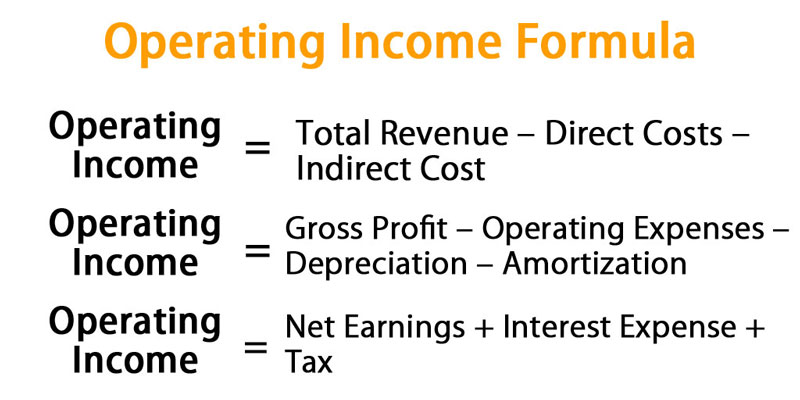

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

Our Cash Offers More Advantageous to Sellers?

Mar 17, 2022