Aug 07, 2022 By Triston Martin

The bank will compensate them through an overdraft account if a customer's payment is rejected or bounces.

The borrower is responsible for paying the interest on all loans, including overdrafts. Due to the lower interest rates on loans than on credit cards, overdrafts can be a better short-term option than using credit cards. Overdraft protection can reduce your available cash because of fees such as per-check or per-withdrawal insufficient funds fees.

Overdraft fees cannot be added to customers' accounts by rearranging their transactions. In 2010, Wells Fargo was fined $203 million for misleading practices that inflated overdraft penalties on client withdrawals.

Extra Attention Is Required

Your bank may use its funds to cover an overdraft you've racked up. You can also use a credit card to link your overdraft. With a bank's resources, you won't have to worry about damaging your credit score. A credit card overdraft can decrease your credit score if you use it to pay for something you didn't plan to. Overdrafts on your checking accounts, on the other hand, are unaffected.

A collection agency may be contacted if you don't pay back your overdrafts within a specified time. Equifax, Experian, and TransUnion may get a report on this collection action from the three major credit bureaus. How the account is reported to the agencies determines whether or not an overdraft on a checking account is recorded. An overdraft that goes unpaid for too long can be turned over to a collection agency by a bank

Inadequate Insurance Coverage

Some banks automatically pay for overdrafts, but not all of them (while charging fees, of course.) An alternative for customers to avoid humiliating overdrafts that negatively affect their ability to pay overdraft insurance is available.

It is generally done by linking your checking account to a different savings/checking/credit account. This source of funds is utilized to ensure that you will not be slapped with a check return or transaction/transfer denial in the event of a deficit. There is also no risk of being charged for insufficient funds (NSF).

Each bank and each account have distinct overdraft protection policies. In many cases, the customer has to make the request. For those considering overdraft protection, keep in mind that banks aren't providing the service out of a desire to help others. There is almost always a price tag attached to everything.

So, users should only use overdraft protection when necessary. Overdraft protection can be removed from an account if it is frequently used.

Do You Need Overdraft?

Our Budget Planner can help you recover control of your expenses if you frequently use your overdraft.

Overdrafts can be useful for some people. There is a chance that they can save you money by preventing returned or bounced checks. If your account balance is insufficient, you will see an error notice similar to this when attempting to make a payment.

Overdrafts should only be utilized in emergencies or as a short-term fix. According to the Financial Conduct Authority, many customers underestimate how much they use their overdrafts (FCA). You may be paying more interest than you realize if you use your overdraft more frequently than you think.

If you constantly use your overdraft, look at the tips below. There is a chance that they can help you save money in the long term. An interest-free credit card may be more cost effective for those who frequently find themselves with an overdraft and lack the funds to pay it off.

Does an overdraft incur a fee?

A bank overdraft loan is accessible to consumers who have run out of money and need to pay their payments and other financial obligations. After an unexpected charge or low balance, the bank gives the customer a fee-based loan to cover the shortfall. These accounts often charge a one-time funding fee and accrue interest on any outstanding balance.

Overdraft Protection: What Is It?

For example, if an overdraft protection feature causes an account to fall into a negative balance, a bank can make a predetermined loan and charge a fee. Overdraft protection is routinely used to avoid the embarrassment of a bounced check. Even if the cost of inadequate cash is avoided, there is no guarantee.

Overdraft costs have both perks and cons.

When a bank account is suddenly depleted of funds, overdraft protection is a terrific method to avoid embarrassing situations and "returned check" costs from creditors or merchants. However, the monetary cost must be taken into account. The overdraft protection fee and charges must be paid as soon as possible to avoid additional financial hardship. However, according to the Consumer Financial Protection Bureau, customers with overdraft protection paid more fees than those without (CFPB).

The Bottom Line

You can still pay your payments and get cash out of your account if you run out of funds. It's useful even if your bank doesn't offer overdraft protection. On the other hand, avoiding overdraft fees and interest charges is the best way to avoid bank overdrafts.

-

Best Places to Retire In Panama

Jun 30, 2023

-

How Often Do They Change My Credit Report?

Nov 12, 2022

-

Best Appointment Scheduling Software for Small Business

Jun 16, 2023

-

Online Broker for Beginners

Jan 14, 2022

-

Yield to Worst (YTW)

Sep 29, 2022

-

Taking the Necessary Steps to Prepare for Retirement

Jul 28, 2022

-

Are Solar Panels Expensive

Jul 04, 2023

-

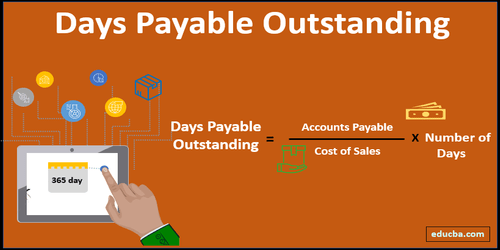

Learn About: What is Day Payable Outstanding?

Aug 08, 2022