Aug 09, 2022 By Triston Martin

If the investor gives a few days' notice, the account holder could, in some situations, permit an early termination—or withdrawal—of their investment. A fee will be charged for early cancellation as well. The main advantage of a term deposit is that if you have trouble resisting the need to spend your money, it may be locked away, preventing you from making impulsive purchases. The predictability of a set interest rate is the second significant benefit. As a result, you will not only know how much money you will make back but should interest rates fall; you will still be locked into the same interest rate. Let us see what advantages a term deposit offer.

Are There Any Drawbacks?

The downside of having your money locked up for the specified period is that if you need to access it sooner, you'll probably have to pay a penalty charge and, in many circumstances, give up to 31 days' notice. Therefore, before locking your money away in a term deposit, you must be sure that you won't require access to it. It's crucial to consider your alternatives once your term deposit expires since certain term deposits may automatically renew at the then-current rate, which may be higher or lower. A disadvantage of locking in a set interest rate is that should rates increase, you won't be able to benefit from a better rate while your money is in a term deposit.

A minimum deposit is often needed for term deposits, and frequency ranges from $1,000 to $5,000. It could be challenging at first to set aside so much money for an extended length of time if you're beginning to save.

What Is A Savings Account?

As the name indicates, a savings account is a bank account created specifically for saving. The money in the account often earns interest while still being accessible when required. When specific criteria are satisfied, such as increasing the account amount by the end of the month, some savings accounts may offer bonus interest. Savings account interest rates are frequently fluctuating. Thus, the total amount of interest due will likely change over time.

What Are A Savings Account's Advantages?

Possessing the flexibility to access your money should you need to while stillCollecting interest is arguably the most significant advantage of choosing a savings account versus a term deposit. Naturally, having quick access to your money may reduce the desire to raid your funds. If you like, whether regularly or whenever you have extra money, you may also add to your savings account. On the other hand, with a term deposit, once you've made the initial deposit, you won't be allowed to make any more deposits until the predetermined time has passed.

They are worth buying

Deposits with a fixed duration are among the most secure methods to put your money to work for you. They are not as precarious as stocks, shares, or other forms of investing capital. This is one of the reasons why it is so amazing. There is no need for you to be concerned about the market or about receiving your money back from the investment you made. You only have to decide on a period, lock in a terrific rate with a guaranteed return, and then you can take it easy while your money earns you money.

Interest gives them more money

Even the most advantageous savings accounts cannot compete with today's low-interest rates. Despite this, opening a savings account is not always a poor decision in every circumstance. However, this is not the case. Whether you should put your money into a savings account or a term deposit is something you need to consider with how often you need access to your funds, how long you are prepared to put them aside, and what you want to use the money for in the future. Nevertheless, for those interested in saving for the long term and making the most money possible, a term deposit is an excellent decision.

They guarantee a specific rate of return

Even though the interest rates on savings accounts and term investments are the same, you must consider the various types of interest you receive when comparing the two types of accounts and investments. On savings accounts, there is a type of interest rate referred to as a "variable rate." This indicates that the interest you receive will fluctuate based on factors such as the state of the economy, the current national rate, and the going rate at your bank or credit union, all of which are subject to change.

A term deposit, on the other hand, comes with a predetermined interest rate. That is, once you lock in a rate, it will not alter for the duration of the period that you have chosen. You don't have to keep an eye on the national rate, nor do you have to depend on a return that may or may not occur. After you have sent in the money, you are immediately assured of your refund.

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

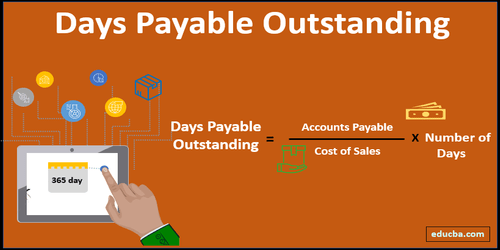

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

Are Solar Panels Expensive

Jul 04, 2023

-

Bank Of America Customized Cash Reward Credit Card Review In Detail

Jul 19, 2022

-

How to Buy a Foreclosed Property

Jul 03, 2023

-

All About Chargeback?

Aug 08, 2022

-

How to Get VA Loan Preapproval

Jul 03, 2023

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022