Aug 03, 2022 By Triston Martin

On May 16, 1792, 25 stockbrokers & traders signed a contract that would eventually become the NY Stock Exchange. The industrial period that has resulted in today's world of too-big-to-fail firms has been fuelled by shareholders who have gained and lost endless billions since that time. Throughout that mega-boom, top officials and executives have made a lot of money, but how have relatively small stockholders accomplished, being tossed around by selfishness and anxiety? The answer to this question is yes, but before you begin, make sure you've read the information provided below.

Invest & Hold

"Time in the market is better than timing the market" is a frequent phrase among long-term investors. How can you explain this? To put it another way, a buy-and-hold strategy is a typical method of making money in the stock market, in which you retain stocks or other assets for a lengthy period of time rather than constantly purchasing and selling them (a.k.a. trading). Consistent traders lose out on chances to earn large yearly returns since they are always coming out and entering the market. What? You don't think so? Think about it: As per Putnam Investments, the share market earned 9.8 percent a year to individuals who stayed completely invested over the 15 years ending in 2017. However, if you entered and exited the market too often, you risked losing out on these rewards.

- The yearly return for traders who skipped only 10 of the greatest days in that span was 5%.

- Those who skipped the 20 finest days of the year had an annual return of only 2%.

- The average yearly loss was -0.4 percent when employees missed 30 of the greatest days of the year.

Obviously, missing out on the finest days of the market results in reduced returns. The simple approach could be to constantly make sure you're invested on such days, but it's tough to forecast when they'll occur, as well as the days of excellent performance occasionally following the days of huge falls; this implies that if you want to make the most of the stock market, you need to commit to a long-term investment strategy. You may attain this aim by adopting a purchase and hold strategy.

Invest In a Fund Rather Than a Single Stock

Investing veterans know that diversification, a tried-and-true strategy for lowering risk and perhaps increasing profits, is critical. Consider it the equivalent of not placing all eggs inside one basket while investing. Individual stocks and stock funds, like index funds or ETFs, are the most popular investment choices for most traders, although professionals advocate the latter to optimize your diversity. While it is possible to replicate the automatic diversification found in mutual funds by purchasing a variety of individual stocks, this may require time, a good bit of investing knowledge, and a significant monetary investment to be effective. It might cost thousands of dollars to buy one share of a particular company's stock.

With mutual funds, you may acquire a piece of a much larger pie by investing in a single share. Although everybody wishes to put their whole wealth in the upcoming Apple or Tesla, the truth is that the majority of investors, even experts, have a poor track record of forecasting which firms will provide outsized returns. Investors are thus advised to put their money in funds that follow key indices such as the S&P 500 and perhaps NASDAQ in a nice way. As a result, you'll be in the best possible position to take advantage of the stock market's about 10% yearly return average.

Invest Your Earnings

A dividend is a payment made to shareholders on a regular basis depending on the company's profits. As little as dividends may seem at first glance, they've been a major factor in the stock market's impressive rise. The S&P 500 earned an average yearly return of 6.8% from September 1921 to September 2021. Nevertheless, when profits were reinvested, that number rose to approximately 11 percent!! This is because reinvesting your dividends allows you to acquire additional shares, which accelerates the growth of your profits.

If you're looking to reap the benefits of compounding, you should consider reinvesting earnings rather than consuming them right away. By enrolling in a dividend reinvestment program (also known as a DRIP), most brokerage firms allow you to reinvest your dividends on a regular basis.

Select the Best Investment Account

The account in which you keep your assets is just as significant as the investments themselves in terms of your long-term investing performance. Why? Because you may be able to take advantage of tax benefits now (conventional retirement funds) or later on (exempt from federal income tax) (Roth). Regardless of which one you select, you won't have to pay taxes on any returns or earnings you make while the cash remains in the account. Your retirement savings may be boosted by delaying taxes on these gains for decades.

These advantages, however, come at a price. You can't take money out of retirement accounts like 401(k) s and IRAs before the age of 59 without incurring a 10% penalty and whatever taxes you owe. As long as you're not in the midst of a financial crisis, you're free to dip into your retirement savings early without incurring a penalty. It's a good idea to leave your money in a tax-favored retirement plan until you have reached the age of retirement.

Investing in traditional taxable accounts, on the other hand, does not provide the same tax benefits but does allow you to withdraw your money anytime you want for any reason. By selling your lost stocks at a loss and claiming a tax break on the part of the profits, you may use tactics such as tax-loss harvesting and transform your losses into gains. There are yearly limits on 401(k) & IRA contributions, but you may add to taxable accounts all year long.

To summarize, investing in the "correct" account is critical if you want to maximize your profits. Investing in tax-advantaged accounts might be a wise choice if you want to preserve your capital gains for the long term or if you expect to require the funds in the upcoming years. Tax-advantaged accounts may be beneficial for assets that might lose more to taxes or that you expect to retain for a long time.

The Verdict

Do not waste your time guessing whether specific stocks will rise or fall in the near run if you wish to earn money in the stock market. In point of fact, some of the savviest traders, such as Warren Buffett, advocate that individuals make investments in low-cost funds and keep hold of them for a number of years till the time comes when they want their money. As a result, the tried-and-true secret to successful investing is, sadly, a bit monotonous. Over the long run, diverse investments will pay dividends rather than chasing the next stock that's a hot commodity.

-

How Do Unsecured Loans Work?

Aug 26, 2022

-

Is Stock Investing Profitable for You

Aug 03, 2022

-

How to Contribute to an IRA as a Gift

Aug 12, 2022

-

Best Places to Retire In Panama

Jun 30, 2023

-

Various forms of algorithm contracts

Oct 05, 2021

-

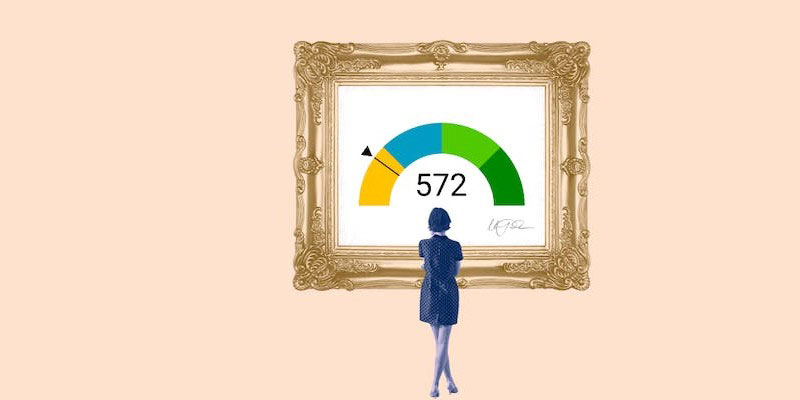

An Overview of 572 Credit Score

May 26, 2023

-

CFA vs. CFP: Which Is Better For You?

Jun 07, 2023

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023