Jun 16, 2023 By Triston Martin

Are you considering tapping into your home's equity to finance a large purchase or consolidate debt? If so, you've heard about cash-out refinancing and home equity loans. These two financing options have several similarities but differ in important ways.

In this blog post, we'll look at the difference between cash-out refinance and home equity loans, including their pros and cons and when each best suits your needs. This information lets you decide which option is right for your financial situation!

Overview of Cash-Out Refinance and Home Equity Loan

Regarding securing additional funds for large purchases or consolidating debt, two popular options are cash-out refinance and home equity loans.

Cash-out refinance a process where you take out a new loan to pay off your existing mortgage and receive the difference in cash. This option can be beneficial if interest rates have dropped since you took out your original loan, allowing you to take advantage of the lower rate.

Additionally, when refinancing with a conventional loan, you can get rid of private mortgage insurance (PMI) payments that were previously necessary with less than a 20 percent down payment.

Home equity loans are second mortgages that allow homeowners to borrow against their home’s equity. This option is often used for large purchases and debt consolidation since the loan amount can be substantial, depending on the home’s value and how much equity has built up. Home equity loans usually have fixed interest rates lower than credit cards or personal loans.

Cash-out refinance, and home equity loans have pros and cons, so it is important to assess your financial needs before making a decision. With cash-out refinance, you may qualify for a larger loan due to the combined total of your existing mortgage balance plus the desired cash-out amount.

However, this option comes with closing costs which can add up quickly if you do not plan accordingly. On the other hand, home equity loans usually have lower interest rates, but the terms are shorter, so you must ensure you can pay it off in the specified timeline.

Advantages of Cash-Out Refinancing

Lower interest rate (potentially)

If interest rates have dropped since you took out your original loan, cash-out can be a great way to take advantage of the lower rate.

No closing costs

There are no closing costs associated with cash-out refinance, making it a more cost-effective option over home equity loans which come with closing costs.

Advantages of Home Equity Loans

Higher Loan Amounts

You may qualify for larger loan amounts than cash-out refinances due to the total of your existing mortgage balance plus the desired cash-out amount not exceeding 80% of the home’s value.

Fixed Interest Rates

Most home equity loans come with fixed interest rates often lower than credit cards or personal loans.

Disadvantages of Cash-Out Refinancing

Closing Costs

Closing costs for cash-out refinance can add up quickly, so plan accordingly.

Disadvantages of Home Equity Loans

Shorter Terms

Home equity loans usually have shorter terms than cash-out refinances, so you must ensure you can pay it off in the specified timeline.

When deciding between cash-out refinance and home equity loans, it is important to consider your financial needs and goals to determine which option best suits you. With this information, you can make an informed decision that will help you achieve your short and long-term goals!

How to Calculate Your Possible Savings

When considering cash-out refinance or home equity loans, it's important to calculate your possible savings. For cash-out refinance, you'll want to determine if the lower interest rate is worth the closing costs associated with the loan.

For home equity loans, you'll want to compare the fixed interest rates to other potential debt consolidation options and ensure you can pay off the loan within the specified timeline. By taking these steps and properly calculating your possible savings, you can know which option will work best for your financial situation!

Determining Which Option Is Best for You

Once you've determined the difference between a cash-out refinance and a home equity loan, the next step is to decide which option is best for your financial situation. To do this, it's important to consider your finances' short- and long-term goals.

For instance, if you have a shorter time frame (such as paying off a large expense within five years), a home equity loan may be a better option since they usually come with shorter terms. However, if you plan on keeping your debt load for several years, then cash-out refinance can help save more money in the long run due to its lower interest rate and no closing costs.

Additionally, it's important to consider each option's risk. Cash-out can come with a higher risk of foreclosure due to the extended loan terms, whereas home equity loans have a shorter repayment timeline and can cause you to lose your home if you fail to make payments in time.

Steps to Take If Interested in a Cash-Out Refinance or Home Equity Loan

Calculate your possible savings

Take the time to compare the interest rates associated with both options and determine if a cash-out refinance or home equity loan is best for you financially.

Check credit requirements

Before applying for either loan, check to ensure you meet the lender's credit score requirement and have a good credit history.

Shop around

Do your research and shop around to compare different offers from various lenders to get the best deal possible.

Get pre-approved

Make sure to get pre-approved before completing an application, as this will help speed up the process once you decide on a lender.

Consider closing costs

Don’t forget to consider potential closing costs when budgeting for either loan.

Have a repayment plan

Once you’ve chosen the loan that best suits your needs, creating a repayment plan and sticking to it is important.

By following these steps and properly calculating your possible savings, you can know which option will work best for your financial situation! With this information, you can decide which financing option is right for you and help ensure the successful completion of your purchase or debt consolidation.

FAQs

Q: What are some pros and cons of each option?

A: Cash-out refinancing offers several potential advantages, including lower interest rates than home equity loans and repayment terms extending up to 30 years. However, it also has significant upfront costs, such as closing costs and points. With home equity loans, you don't have to pay much upfront costs, but the interest rates are typically higher than with cash-out refinance loans.

Q: When is each option best?

A: Cash-out refinancing is a good option when you need to access large sums of money quickly and when you want to lower your monthly payment amount. Home equity loans are better suited for smaller loan amounts and shorter repayment periods. If you're considering either of these options, it's important to research and compare different lenders to get the best rate and terms for your situation.

Q: How will these loans affect my taxes?

A: Generally, the interest on cash-out refinancing or home equity loans is tax deductible. However, there may be certain limitations on the amount of interest you can deduct. It's important to consult with a qualified accountant or tax advisor for advice specific to your situation before taking out either type of loan.

Conclusion

Cash-out refinance, and home equity loans offer different advantages and disadvantages, so understanding each option is important before deciding which loan type is right for you. With this information, you can make an informed decision that will help you achieve your short-term and long-term financial goals!

-

How To Get A Secured Business Loan

Jun 13, 2023

-

Refinancing 101: Should You Refinance Your Student Loans?

Jun 14, 2023

-

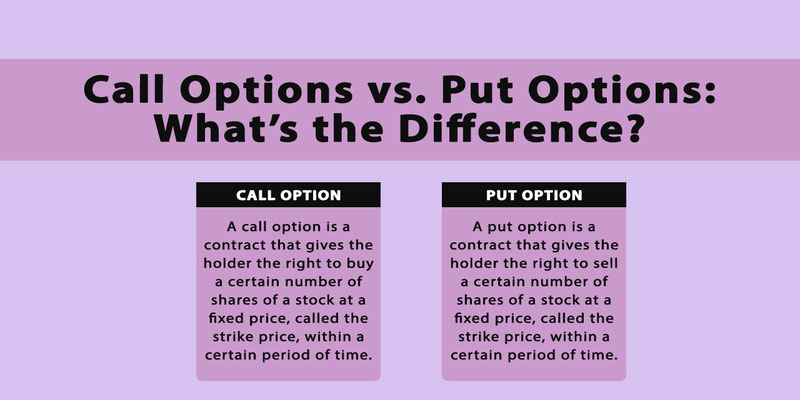

What is the Difference Between Call Option vs. Put Option

Jun 03, 2023

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

Yield to Worst (YTW)

Sep 29, 2022

-

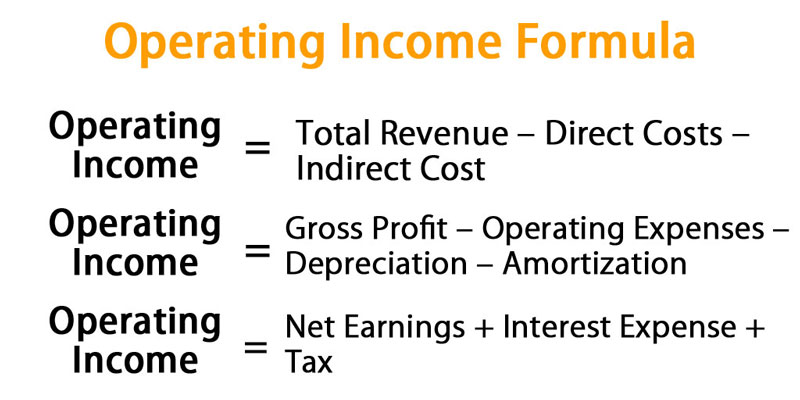

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

Are Solar Panels Expensive

Jul 04, 2023

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022