Jul 28, 2022 By Susan Kelly

After subtracting operating expenditures from gross profit, operational income evaluates a company's efficiency and performance. Here is a complete guide about what is operating income.

What Is Operating Income?

Depreciation and other operational costs like salaries, wages, and the cost of goods sold are subtracted from operating revenue to arrive at this financial metric (COGS). Operating income, which is also called "income from operations," is a company's total revenue minus its cost of goods sold (COGS) minus all of its operating costs. Operating expenditures, like office supplies as well as utilities, are costs incurred as a result of a company's regular operations.

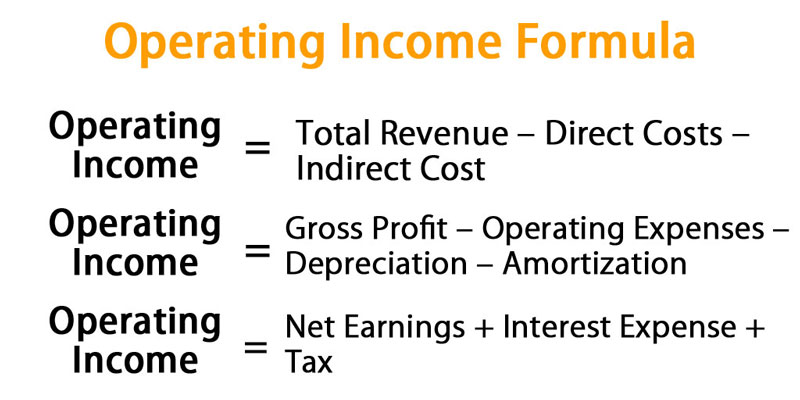

How Do You Calculate Operating Income?

Gross profit is the difference between revenue and the cost of products sold, as calculated from the income statement's top line items. Even after subtracting all operational expenditures from gross profit, operating income still only includes charges such as payroll taxes and interest.

Examples Of Operating Income

Operating income is a commonly used metric for assessing the operational performance of a company. In the first two quarters of the fiscal year, Company ABC, a leading hospital and medication company, saw its operational income climb by 20 percent year-over-year to $25 million. Over the course of the last two quarters, the greater number of patients served by the firm contributed to a rise in both its revenue and its operating income. The company's two newly developed immunotherapy medications are primarily responsible for the increase in patient visits: Lung cancer is treated with one medicine, whereas melanoma is treated with the other.

During the first quarter of the fiscal year, we have Company Red reporting financial data. When compared to the same quarter the previous year, the company's operational income increased by 37%. Since the firm plans to combine with Company Blue and shareholders will vote on the proposed merger next month, the operational income report is of particular importance. However, the operational income rise of Company Red might give Company Blue stakeholders confidence in voting to combine the two firms, despite a 3% drop in first-quarter revenues.

What Is the Purpose of Operating Income?

Profitability ratios may be calculated by comparing operational income to another benchmark, such as sales. A measure of operational profit, or operating margin, compares operating profit to sales. Since corporation tax regimes vary from country to country, they may be used to compare firms in the same sector operating domestically and internationally.

Do You Know the Limits of Operating Income?

In assessing profitability and the effectiveness of top management, operational income is inadequate since it does not account for all expenses. Taxes and interest payments are not included in this calculation.

In A Business, What Role Does Operating Income Play?

A company's operating income is seen as a key measure of how well it is doing. It's a way to gauge a company's potential to make more money, which can subsequently be used to expand the company's operations. Investment analysts pay attention to a company's operating profit in order to see how efficient it has become over time. One of the most important financial metrics in determining a company's value is operating profit, which includes gross profit and net profit. As a company's operational profit grows, so does the efficiency of its main business.

Special Considerations

It's critical to understand the distinction between operating income and net income (and also gross profit). Gross profit, which is mostly comprised of manufacturing expenses, only accounts for a portion of operating revenue. COGS, or the cost of goods sold, is included in operational income, as are operating costs. Other income, non-operating revenue, and non-operating costs are not included in operational income. As a result, they are included in the company's net income.

What Is the Difference Between Operating Income and Profits?

Yes, but it's not quite like that. After subtracting the cost of products sold (COGS) as well as other operating expenditures from sales revenues, operational income is what is left. Taxes, interest, depreciation, and amortization are not included in this calculation.

What Is Non-Operating Income?

This is the part of an organization's earnings that comes from sources outside its main business operations, as opposed to operational income. It might include dividends, interest, profits or losses from investments, and also losses suffered in foreign currency and asset write-downs.

Conclusion

Analysis of a company's income statement gives a snapshot of the company's financial performance, as well as an understanding of the company's historical patterns. You must divide the company's profit depends on its primary business strategy.

-

Best Appointment Scheduling Software for Small Business

Jun 16, 2023

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

See How: Is It Possible to Retire at 45 With $500,000?

Jul 23, 2022

-

Best Places to Retire In Panama

Jun 30, 2023

-

What Is an Overdraft?

Aug 07, 2022

-

Mortgage Review For Quicken Loans In 2023

May 25, 2023

-

How to Buy a Foreclosed Property

Jul 03, 2023

-

What are gold ETFs?

Jan 05, 2022