Jul 23, 2022 By Susan Kelly

Introduction

It's merely a game of numbers, to put it simply. Numerous experts advise saving a minimum of $1 million for retirement, but this does not consider your objectives, preferences, or spending patterns. It's possible that you can live nicely in retirement with less than $1 million. For instance, if you have $5000 in savings, this might be enough to cover your demands. You alone will determine how much money you ultimately need to retire. If you have any particular worries regarding your retirement plan, A financial advisor might be able to help.

How Much Does a Regular Retirement Cost?

According to Bureau of Labor Statistics data, the average senior makes $55,700 a year. The entire cost for a 20-year retirement would be $1.114 million. The $1 million number is therefore not too far away. The cost of health care accounts for a sizable amount of this expenditure. According to Fidelity Investments, a 65-year-old couple may expect to spend about $300,000 on medical bills throughout their lifetime. The amount does not reflect ongoing expenses for older adults who require home healthcare or assisted living. Genworth is a provider of insurance. Genworth calculates that it would cost roughly $105,000 annually to offer nursing home care in a private bedroom.

Medicare does not offer long-term care coverage, but Medicaid does. The Medicaid eligibility standards may require seniors to spend their retirement assets to be eligible for the program. Benefits from Social Security may improve retirement savings, but only to a limited extent. While the average monthly payment is $1,657, the maximum Social Security payout for 2022 is $4,194. Putting some numbers together, it could seem impossible to retire with $500,000. Don't entirely discount it, though. To make it happen, you must accurately estimate and manage your living expenditures before and after retirement.

With a withdrawal rate of four and $500k, the computation equals about $20,000 per year. Be mindful that applying the 4 percent guideline indefinitely won't be practical. It is made to endure 30 years of retirement, which won't be enough if you are in good health when you retire at age 45. A $500K retirement at age 55 might give you a better chance of achieving financial success.

A Guide to Retiring on $500 000

Is it possible to retire at 45 With $500,000? By creating a mock-up of your retirement budget, you can decide whether your $500,000 objective is attainable based on your current lifestyle and the lifestyle you hope to lead. The budget should account for necessities, including utilities, food, housing, transportation, medical care, leisure activities, and travel. Review your spending patterns if you don't know where to begin. Maintain a spending log for at least six months. Then, you can reflect on several crucial issues, such as:

- Are your current expenses likely similar to your future costs after retirement?

- Do you currently incur any expenses that could increase or decrease if you retired? Anything that might vanish?

- Do you have any areas of spending that you could include in your budget once you retire?

These inquiries might help you calculate the cost of maintaining your standard of living in retirement and will aid in choosing the correct draw-down rate. Most experts advise taking no more than 4% of your retirement assets annually to guarantee that your retirement resources last. Realistically, if you are granted $500,000 for retirement, you can withdraw $20,000 in your first year of retirement. The sum would gradually diminish every year after that while your portfolio's development would stop.

Your annual earnings will increase to almost $39,000 if you take the $20,000 figure and add the $1,657 median Social Security payment. This assumes that you will postpone receiving Social Security benefits until you retire. In addition, starting Social Security at age 62 may result in lower costs, whereas deferring benefits gradually until age 70 will result in higher benefits.

Where Can I Go To Get More Information?

- Look up the SuperGuide page on How Much super will I need to retire for further information on the factors to consider when determining your retirement income needs.

- These tables' data only represent a small portion of all potential possibilities. Check out SuperGuide's Super to Income Reckoner, which offers more than 4,500 options, if you want to enter your numbers.

- We also advise using our Retirement Planner calculator to estimate your retirement age, duration of retirement, projected returns on assets, and your expected super balance. Users of the calculator can include investments and savings from outside the family.

Conclusion

If you're lucky enough to have the option, deciding when to retire can be difficult. You risk running out of wealth if you quit too soon. If you leave too soon, you might not be able to go on the experiences you had hoped for.

-

Various forms of algorithm contracts

Oct 05, 2021

-

How to Start Renting Out Your House for the First Time

Jun 03, 2023

-

What is a Closing Disclosure

Jul 04, 2023

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

How Do Unsecured Loans Work?

Aug 26, 2022

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

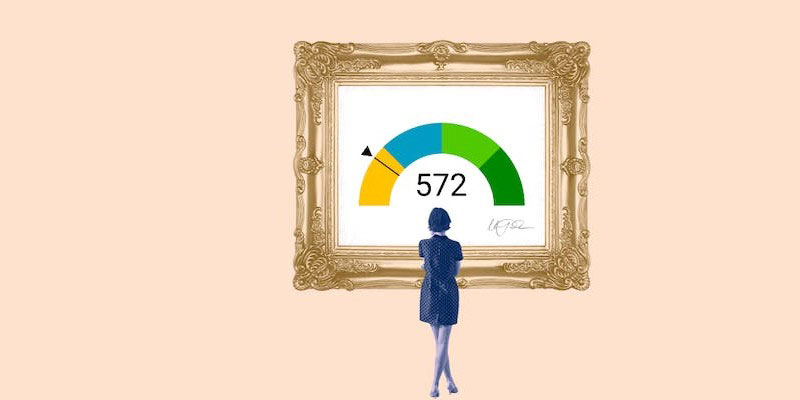

An Overview of 572 Credit Score

May 26, 2023

-

What Factors Affect Social Return on Investment (SROI)?

Sep 09, 2022