Jul 15, 2022 By Susan Kelly

Loans for the purchase of a mobile home are available from lenders who specialize in mobile home loans. Most mobile homeowners don't own the property where they park their houses since mobile homes may be relocated. Personal property rather than real estate includes mobile homes because of this. A chattel or personal loan is commonly used to get financing.

The most acceptable mobile home loans include low-interest rates and a wide range of options to fit your needs. Among its advantages are modest down payments and a wide range of credit scores. These lenders may provide various loans if you want to buy a freshly constructed or used mobile home.

Kinds Of Mobile Homes

Many types of homes, including some that aren't movable, are referred to as "mobile homes." Other subcategories include prefabricated houses and modular homes.

Mobile Homes

Movable houses, as the name suggests, are just that: mobile. Mobile homes include tiny residences, travel trailers, and even modified vehicles. Mobile homes are pre-1976 factory-built structures in the United States that do not meet current HUD code criteria. HUD and most lenders consider manufactured houses built after standards were adopted to be manufactured homes, yet many individuals still refer to them as mobile homes.

Manufactured Homes

The most prevalent type of mobile home is a manufactured house. They are built at a factory and then sent to a lot for construction. The foundation, which is most typically a slab, is used to secure them to a single location for the duration of their use. While prefabricated homes may technically be relocated from one site to another, it is typically cost-prohibitive.

Modular Homes

If you've ever been stopped in traffic behind what looks like a house chopped in half, then you've seen a modular home. Even though modular homes are built off-site, they are still prefabricated houses shipped in and installed on-site. Compared to a typical manufactured house, they are often significantly larger structures with additional features like second floors, garages, patios with roof covers, and even basements.

Mobile Home Stats

According to a Consumer Financial Protection Bureau analysis, just 6% of all inhabited housing units are manufactured houses, but the number of loans for these units is substantially higher.

Whether you call them "financially vulnerable" or "older adults," those who live in manufactured homes are more likely to have low self-reported incomes, which means they are more likely to be offered less-than-favorable loan terms and rates, according to the Consumer Financial Protection Bureau (CFPB).

More than a third of manufactured home families are led by retirees, according to the Consumer Financial Protection Bureau (CFPB). They have a net worth that is less than one-quarter of that of the average American household.

Financing Options

The conventional and chattel mortgage were the only two forms of prefabricated house financing available at the time. As the prefabricated house business has progressed over the years, more alternatives have been available. Foreclosure safeguards, information on loan conditions, and so on are integrated into conventional mortgage alternatives. In addition, their interest rates are significantly lower.

Homeowners who own their land outright and do not rent their land cannot obtain a traditional mortgage since their prefabricated house is not permanently attached to the land on which it is situated.

Mobile Home Loans of 2022: The Best

Manufactured Nationwide

Magnolia Bank's Manufactured Nationwide segment is a wholly-owned subsidiary of the bank. Because the firm loans in all 50 states and is an expert in low-down-payment, government-backed lending programs, it is our top mobile home lender.

Manufactured Nationwide provides manufactured, mobile, and modular home loans for new and used houses with single-, double-, and triple-wide widths. This portion of the housing market can use government-backed credit programs like VA, FHA, and USDA to get affordable fixed-rate mortgages.

ManufacturedHome.Loan

National mortgage broker ManufacturedHome.The loan is located in New Jersey. They can assist you in acquiring the best rates and terms possible by working with eLend, a partner firm. This is the most incredible loan option for individuals with good credit because of the low rates.

MHL can help you buy or refinance a mobile home, new or secondhand. In contrast to most mobile home lenders, MHL may offer a broader range of financing choices for people who want to buy a house but don't already own the property on which it will be built.

Corporation: 21st Mortgage, Inc.

The Knoxville, Tennessee-based 21st Mortgage Corporation was established in 1995 and employed more than 800 people. After being acquired by Clayton Homes in 2003, the business became a Clayton Homes subsidiary. Except for Massachusetts, Rhode Island, and sections of Illinois, it lends in the contiguous United States. It's the ideal option for people with terrible credit because it doesn't require a credit score and can finance mobile homes. 21st Mortgage Corporation provides prefabricated home borrowers with cutting-edge fixed-rate financing options.

-

Difference Between Cash-Out Refinance And Home Equity Loan

Jun 16, 2023

-

Everything You Need to Learn About the Best Personal Finance Courses

Jul 13, 2022

-

A Complete Guide: The Returns of Short, Intermediate, and Long Term Bonds

Sep 10, 2022

-

Is It Good Or Bad To Have A Credit Score Of 811?

May 26, 2023

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022

-

Ways to Open a Savings Account

Feb 20, 2023

-

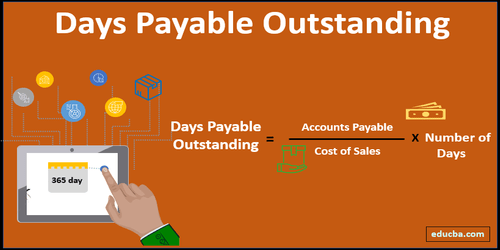

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

Refinancing 101: Should You Refinance Your Student Loans?

Jun 14, 2023

-

The inevitable trend of the development of things

May 24, 2021

-

Bank Of America Customized Cash Reward Credit Card Review In Detail

Jul 19, 2022

-

Various forms of algorithm contracts

Oct 05, 2021

-

Yield to Worst (YTW)

Sep 29, 2022