May 26, 2023 By Susan Kelly

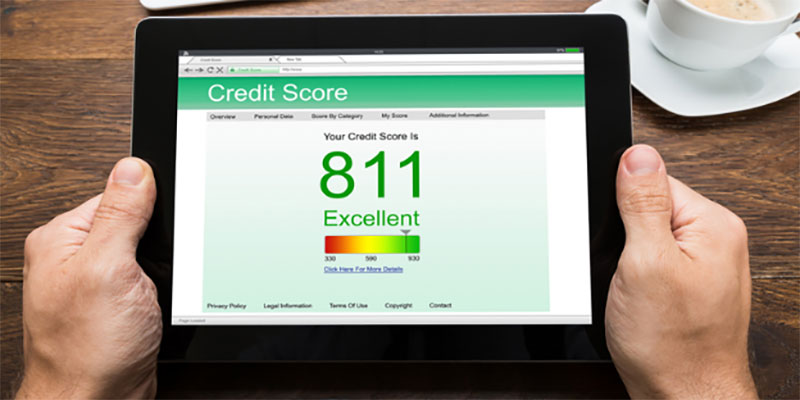

Lenders and financial organizations use a person's credit score, a mathematical representation of their creditworthiness, to determine how much of a risk it is to lend the person money or provide credit. The subject of whether or not a 811 credit score is good or bad is a prevalent one. In this detailed explanation, we'll examine what an 811 credit score means and how it affects many areas of your financial life. Our goal is to help you gain an in-depth grasp of the topic by analyzing the various aspects of credit scores, defining the credit scoring ranges, and weighing the pros and cons of having an 811 credit score.

What Is A Credit Score?

A person's creditworthiness and financial history can be quantified by looking at their credit score 811. It's a three-digit number that helps financial organizations and lenders determine the creditworthiness of a person. Credit scores result from a mathematical algorithm's analysis of information including but not limited to payment history, credit utilization, length of credit history, credit mix, and the number of credit applications.

A higher credit score indicates better creditworthiness on the standard scale of 300 to 850. One's propensity to make timely payments and handle credit responsibly is reflected in their credit score. Lenders use credit scores to determine loan eligibility, interest rates, credit limitations, and other consumer borrowing and lending aspects. Credit scores affect more than just the capacity to borrow money; they can affect the cost of living, the availability of insurance, and even career opportunities.

How Is The Credit Score Determined?

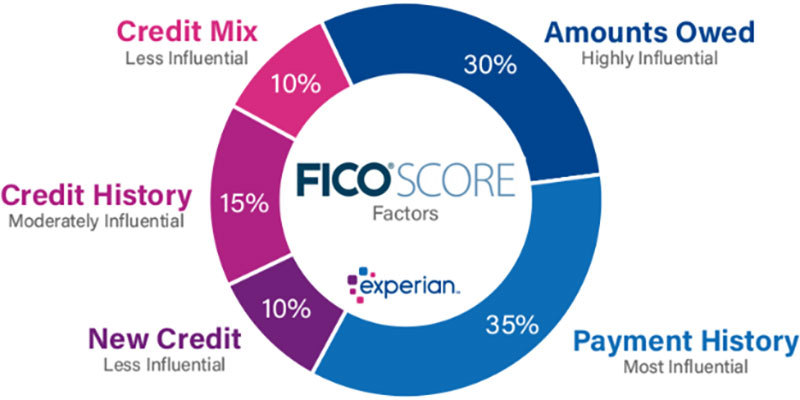

A credit score results from a lengthy and intricate algorithmic analysis of a person's credit history. Various credit scoring models may use multiple calculation formulas, but they all consider the same factors. Credit utilization, which assesses how much of a person's available credit they are using, and payment history, which evaluates the regularity and timeliness of payments made on credit accounts, are two such factors.

The age of the oldest account and the average age of all charges are considered to determine credit history length. New credit inquiries evaluate recent credit applications and credit mix feels the different kinds of credit used. Credit-scoring businesses use their secret formulas to determine each item's relative weight. Lenders can use the credit score to determine an applicant's creditworthiness.

Ranges Of Credit Scores:

The range in which credit ratings often fall provides some context for lenders and borrowers alike. While specific fields may change depending on the scoring mechanism, 300–850 is a typical range. A person's creditworthiness can be roughly classified using credit scoring ranges as a guide. These margins of error help banks and other financial organizations determine whether to extend credit, at what interest rate, and under what conditions.

While different credit scoring models may utilize somewhat different ranges, this guide will cover the most often used ranges and explain what they mean. We'll closely examine each price bracket and talk about the credit history, borrowing capacity, and monetary ramifications that come with it. Increasing credit ratings indicate a more reliable borrower.

The Results Of A Credit Score Of 811:

A credit score of 811 is exceptional and may significantly influence one's financial situation. Individuals with scores in this range are more likely to take advantage of favorable loan terms and credit management options. A high credit score, such as 811, makes it possible to use more lending options and better interest rates when applying for credit. Banks and other lending institutions see those with such ratings as responsible borrowers, lowering their risk. A bigger credit limit on a credit card could mean better spending power for someone with a credit score of 811. They may also be eligible for a greater variety of credit and loan options and premium credit cards.

Conclusion

A credit score of 811 is exceptional and indicates an excellent credit history. Lenders and financial organizations often view this as a perfect credit score. An individual's financial situation improves significantly with a credit score of 811. This includes access to better interest rates, more significant credit limits, and more lenient loan terms. Paying bills on time, using credit sparingly, and preserving a balanced credit profile are all factors that contribute to a high credit score. It's also an indicator of a lesser probability of loan default. A high credit score, such as 811, indicates financial stability and opens many doors for you.

-

Depository Trust Company

Aug 16, 2022

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022

-

Mortgage Review For Quicken Loans In 2023

May 25, 2023

-

How To Get A Secured Business Loan

Jun 13, 2023

-

Is It Good Or Bad To Have A Credit Score Of 811?

May 26, 2023

-

What Factors Affect Social Return on Investment (SROI)?

Sep 09, 2022

-

How Do Unsecured Loans Work?

Aug 26, 2022

-

10 Financial Certifications to Advance Your Career

Jun 29, 2023