Jun 13, 2023 By Susan Kelly

Are you considering a loan to start or expand your business? Secured business loans can be an attractive option for many entrepreneurs, as they offer potential access to considerable capital with favorable repayment terms and rates.

If you're in the market for a secured loan, this blog post will explain how to get one: what types of loans are available, what documentation is required, and best practices when applying.

Whether you're just starting or looking to take your business to the next level – there's no better time than now! Read on for everything you need to know about securing a secured loan.

Understand the eligibility criteria for business loans

Before applying for a secured business loan, it is important to understand the criteria lenders will typically use to assess your application. Generally speaking, most lenders will consider factors such as:

- The creditworthiness of your business

- Your past repayment history on existing loans

- Your current cash flow and profitability

- Any collateral you have to offer

- The amount of the loan

It is important to know that some lenders may also require additional criteria, such as a minimum time in business or a certain annual revenue level. Knowing what these requirements are ahead of time can help you make sure that you meet them before applying for the loan.

Research the different types of secured business loans available

Before you apply for a secured business loan, it’s important to take the time to understand the different types of loans that may be available. Each type of loan will have its own set of requirements and benefits.

Researching various loan products can help you decide which is right for you and your business needs. You can also speak to a financial advisor or lender to help you make an informed decision.

Calculate your company's financial needs and compare loan offerings

To ensure you get the best loan repayment terms, it is essential to accurately calculate your business’s financial needs before applying for a secured business loan.

Once you know how much money you need, compare loan offerings from different lenders and consider all the fees associated with each option. This will enable you to select the most suitable lender and get the best terms possible.

Make sure you meet the requirements for a secured loan

Secured business loans are a great way to get the funds you need for your business. However, it’s important to understand that these loans require more steps and considerations than unsecured business loans.

The requirements for a secured loan vary from lender to lender. Generally, most lenders require applicants to have a good credit score and provide collateral to secure the loan. Collateral is typically an asset such as real estate, equipment, vehicles, or inventory that can be seized in the event of nonpayment.

Having all your financial documents in order is important to get approved for a secured business loan. This includes your business plan, financial statements, and bank statements. These documents will help lenders get an idea of your business's financial health and assess whether you can afford to take on a loan.

It’s also important to shop around for lenders who offer secured loans. Compare interest rates, repayment terms, and other features to find the loan that best fits your needs. Additionally, read the fine print and understand all the fees associated with a secured loan before signing any paperwork.

A secured business loan is possible with good credit and collateral. However, it’s important to shop around for lenders, compare interest rates, and understand all the fees associated with a loan to ensure you get the best deal.

Prepare a detailed application that includes all the necessary information

Before applying for a secured business loan, ensure you have all the documents and information readily available. This includes an updated business plan with detailed financial projections, personal financial statements, tax returns, cash flow statements, and bank account records.

In addition to this, you will also need to provide a list of past and current clients/customers, an organizational chart of the business, and any previous credit or loan records.

It is important to be thorough in your application, as lenders must review all the information provided to get a clear picture of your financial situation. This also helps them determine whether you can repay the loan based on the terms offered.

In addition, you will need to provide any necessary collateral to secure the loan. This could include assets such as real estate or equipment that can be used to guarantee loan repayment. The amount and type of collateral required may vary depending on the lender's requirements, so discussing this with them beforehand is important.

By preparing a detailed application with all the necessary information, you’ll be well on your way to getting the secured business loan you need. This will demonstrate your seriousness and help you get approved for the loan. Researching different lenders to find one that best fits your needs is also important.

This may include comparing interest rates, repayment plans, and other requirements. Researching ahead of time can save you a lot of money in the long run. When it comes to getting a secured business loan, preparation is key! That way, you’ll be able to secure the funding you need as quickly and cost-effectively as possible.

Gather documents

If you’re applying for a secured business loan, you must provide the lender with documentation supporting your ability to repay the loan. This includes bank statements, tax returns, proof of income or revenue streams, and any other financial documents that may be relevant to your case.

The more comprehensive your paperwork is, the better. This will prove to the lender that you are serious about your loan request and will help ensure you get the best terms possible.

FAQs

What is a secured business loan?

A secured business loan is a loan that is backed by collateral. If you fail to repay the loan, the lender can seize assets such as property or equipment to recoup their losses.

Are business loans secured?

Yes, many business loans are Secured. By offering assets as collateral, you may secure more favorable loan terms and lower interest rates than an unsecured loan.

How easy is it to get a secured loan?

Getting a secured loan can be straightforward if you have the necessary documents and meet the eligibility criteria. Preparing an application that includes all the required information and any relevant supporting documentation is important.

Conclusion

Obtaining a secured business loan takes work. The most important thing to remember is to research and prepare beforehand to ensure you are eligible for the loan.

Understanding the eligibility criteria, researching the different types of loans, and calculating your company's financial needs are key to finding the right loan option. You must ensure all your paperwork and documentation are ready as needed.

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

How to Contribute to an IRA as a Gift

Aug 12, 2022

-

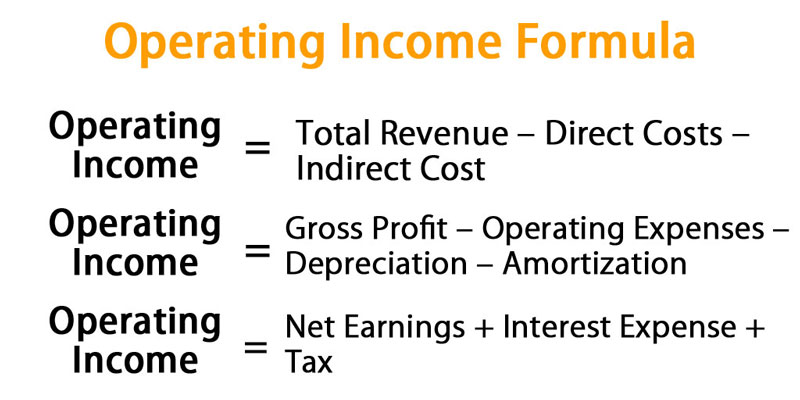

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

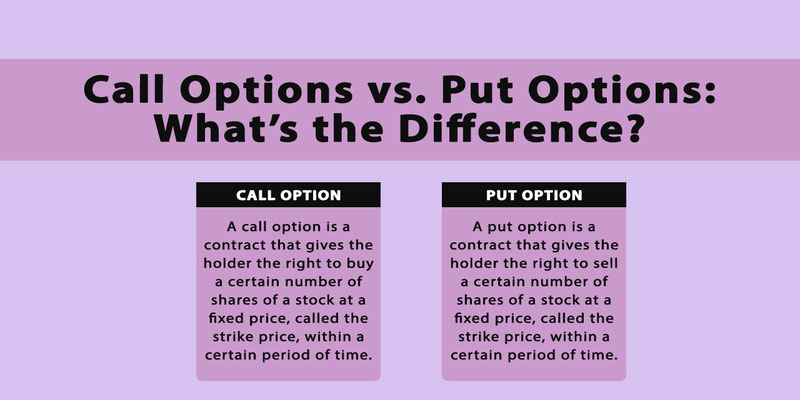

What is the Difference Between Call Option vs. Put Option

Jun 03, 2023

-

What Is ROI On Real Estate Investments

Jun 14, 2023

-

CFA vs. CFP: Which Is Better For You?

Jun 07, 2023

-

Tennessee Housing Development Agency Lenders

Jan 13, 2023

-

Ways to Open a Savings Account

Feb 20, 2023