Jan 13, 2023 By Susan Kelly

You're likely aware of the large variety of mortgage loans available in the market if you've considered purchasing real estate in Tennessee. This is encouraging since it means that even if a prospective buyer is rejected for one mortgage, they may still be approved for another. The Tennessee Housing Development Agency (THDA) is a potential mortgage loan owner if you purchase a home in the state (THDA).

When and why did THDA start? In 1973, the THDA was established to accomplish great things. One of its key goals is to stabilize the residential building business in Tennessee so that it can better serve the state's residents and low- and middle-income households. Its other goals are to help people get qualified for rental aid, to preserve and revitalize existing housing units for persons with low to moderate incomes, and to offer growth for enterprises and social programs associated with the residential building industry.

Just What Role Does THDA Play?

Regarding housing, THDA is the go-to organization in Tennessee for federal and state programs. To further facilitate access to finance for first-time homebuyers and military veterans, THDA is also authorized to issue tax-exempt Mortgage Revenue Bonds.

There is no direct lending from THDA. It buys mortgage loans from banks and other financial institutions that meet specific criteria.

What Do You Get With a THDA Loan? All THDA loans come with a fixed interest rate for 30 years and the option for a low down payment. Fewer options exist for discount and origination points. To qualify for down-payment assistance, all purchasers must take a homebuyer education course (which is recommended for everyone.

So, What Exactly Does the THDA Need? To qualify for a THDA loan, your income must meet minimum requirements. Two have to do with the buyer, while the other is related to the house.

Credit Rating of Borrower

Lenders will only consider a loan application with a 620 credit score, the current minimum score required by the Federal Housing Administration. Money coming in for the borrower There is a maximum household income that varies from county to county in Tennessee.

An Analysis of the Housing Market, The maximum price of a home eligible for THDA assistance varies by county. It's essential to keep in mind that the program will only provide funding for very inexpensive homes.

Can I Get a THDA Loan If I Have Bad Credit?

There are indeed three distinct THDA loan options. First, Great Choice is a program tailored specifically to first-time homeowners in the Volunteer State. The second is called "Repeat Homebuyers," and it applies to those who aren't buying their first home but are relocating to one of the counties in Tennessee that the THDA focuses on. Last but not least, we have Military Homebuyers. Veterans who have served their country and met the THDA conditions are eligible for this loan.

MIG is pleased to be able to provide THDA loans to its clients. Get in touch with us immediately to discover your eligibility and have all your mortgage loan queries answered.

MIG has established itself as a leading residential mortgage lender in the Southeast and continues expanding. Established in 1989 and headquartered in Knoxville, the firm has as many as 400 employees. It has been the top lender for the Tennessee Housing Development Agency (THDA) every year since 2003, and it has been the top lender for the USDA in Tennessee every year since 2014. MIG is dedicated to serving borrowers throughout the Southeast even as it grows.

All prices are subject to change.

Locking in a rate at the current term can secure your payments for anywhere from 30 to 180 days, depending on the program type, credit history, property location, and other factors. Depending on factors including program type, credit history, property location, etc., the time that a rate lock is available at the present rate and term can range from 30 to 180 days.

Costs will range from program to program, property to property, and location to location. Unfortunately, only some states have access to every program. First-time buyers may need help qualifying for specific financing programs. Limits and other restrictions may apply based on the specifics of the loan program. Data is often based on an owner-occupied, no-cash-out refinance of an existing principal house.

You can talk to a friendly MIG Loan Officer about your specific financial circumstances, and they'll help you narrow down which loan options best suit your needs.

-

An Overview of 572 Credit Score

May 26, 2023

-

UnitedHealthcare Medicare Review

Feb 28, 2022

-

Lenders for Mobile Home Financing

Jul 15, 2022

-

Everything You Need to Learn About the Best Personal Finance Courses

Jul 13, 2022

-

How Often Do They Change My Credit Report?

Nov 12, 2022

-

How To Get A Secured Business Loan

Jun 13, 2023

-

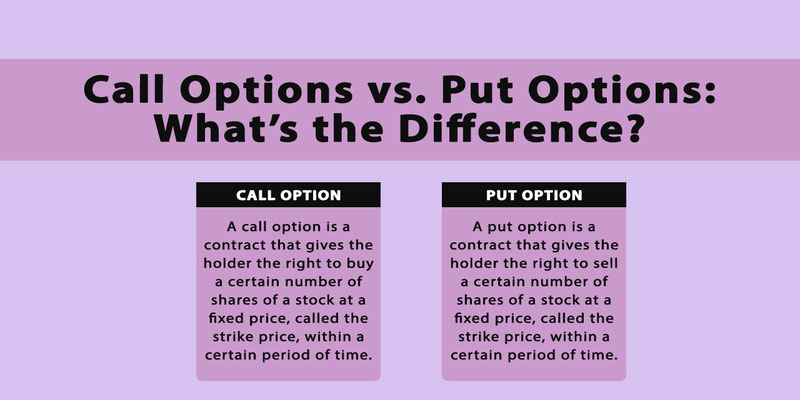

What is the Difference Between Call Option vs. Put Option

Jun 03, 2023

-

10 Financial Certifications to Advance Your Career

Jun 29, 2023