May 26, 2023 By Triston Martin

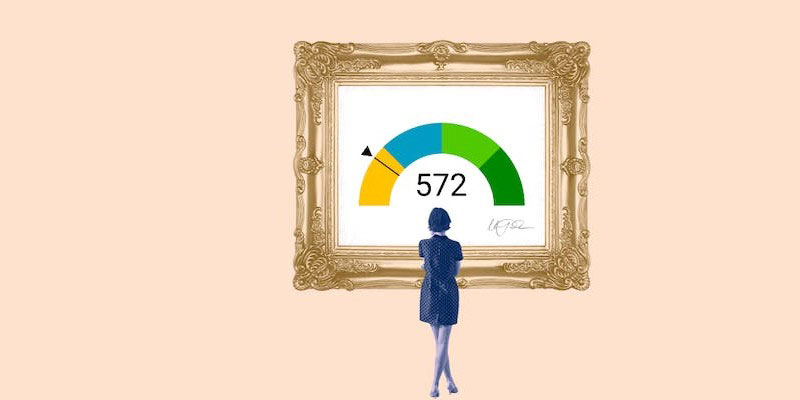

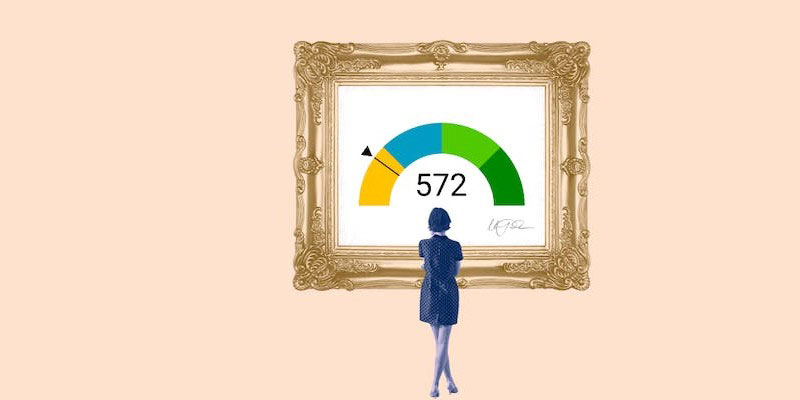

A credit score of 572 needs to be better and put you in the subpar category of borrowers. A FICO credit score below 580 is generally considered poor, while the average American consumer has a score of 714.

As previously noted, a credit score of 572 is considered low. More on this will be provided, but your income and employment status will determine the types of loans you can apply for. Poor credit customers are seen as high risk by lenders, so even if approved, they will likely pay more excellent interest rates and fees than those with better credit.

Learn more about the implications of a credit score of 572, the types of loans for which you may be eligible, and what you can do to raise your credit score.

Methods to Better Your Credit Score

Your credit score of 572 is significantly lower than the average credit score of 714. The good news is that you have plenty of chances to boost your current score.

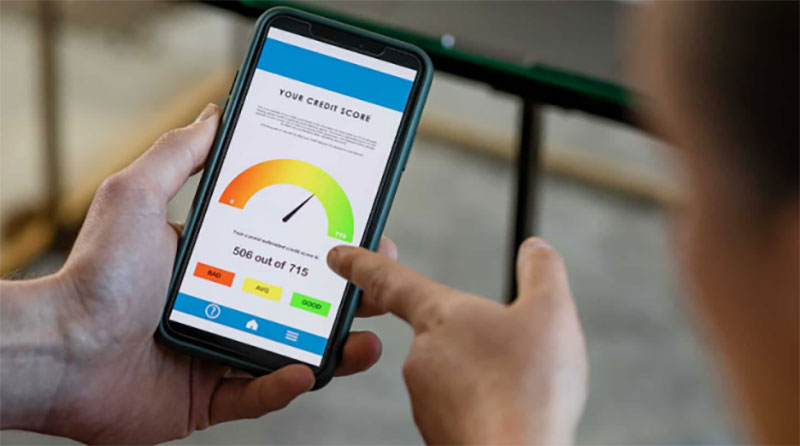

Getting your FICO® Score is a significant first step in improving your credit. A report detailing the major events in your credit history reducing your score will be sent alongside the score. This data is taken straight from your credit report, so it can help you identify areas for improvement.

A FICO® Score in the Very Poor level typically indicates a pattern of credit failures, such as many late or missed payments, loan default or foreclosure, or even bankruptcy.

You should receive your credit reports from Experian, Equifax, and TransUnion and review your FICO® Score report to determine which credit issues are most pressing. Understanding the mistakes on your credit report will help you avoid repeating those same mistakes as you attempt to improve your credit score. It stands to reason that better credit habits would lead to higher credit ratings.

With A Score Of 572, Can I Receive A Credit Card?

We won't paint a rosy picture. A standard credit card approval is out of the question, with a credit score of 572. Since credit cards aren't backed by anything tangible, banks are more careful with them than with a mortgage or car loan.

A few choices exist. Authorization to use another person's credit card can be granted. On the other hand, you could get a secured and fast credit card. Secured credit cards function and report to credit bureaux in the same way as unsecured ones do. However, to "secure" a credit card account, you must usually deposit an amount equivalent to your credit limit.

Boosting Your Credit Score

Improving from a score of 300 or lower to one of 580-669 or 670-739, considered Good, takes time. It can only be done slowly, and you should avoid running away from any company or consultant who tries to convince you otherwise. A strong credit score takes time, but if you start working on it immediately, you can notice steady gains within a few months. Some good places to begin are:

1. Make A Plan To Deal With Your Debts

A debt management strategy may help you escape the burden of your loans and credit card payments. You consult a non-profit credit counseling service to create a repayment plan that works for you. When enrolling in a DMP, you must legally cancel all your credit card accounts. Credit scores can drop significantly, but they have a better chance of recovering from this than they would from filing for bankruptcy. A credit counselor (not a credit-repair firm) can help you develop a strategy to improve your credit score if this seems too drastic.

2. Think About A Credit-Builder Loan

These low-interest loans are standard perks credit unions offer their members to help them establish or repair credit. One ordinary sort of credit-builder loan involves a credit union lending you money but depositing it into an interest-bearing savings account on your behalf.

When the loan is paid off, you get the original amount borrowed plus interest. The credit union will help you save money and build credit by reporting your payments to significant credit bureaux.

The loan can help your credit score if you pay on time consistently. (Before applying for a credit-building loan, verify that your chosen credit union will submit your monthly payments to each of the three major credit reporting agencies.)

3. Get A Credit Card With A Security Deposit

You put down a deposit equal to your desired credit limit on a secured credit card, which is often only a few hundred dollars. Your FICO® Scores will increase as the lender updates your credit files with information about your responsible usage of the card and timely payments to the major credit bureaux. If you use a secured credit card responsibly, making payments on time and without exceeding your credit limit, you can improve your credit score.

-

Various forms of algorithm contracts

Oct 05, 2021

-

Everything You Need to Learn About the Best Personal Finance Courses

Jul 13, 2022

-

An Overview of 572 Credit Score

May 26, 2023

-

Tennessee Housing Development Agency Lenders

Jan 13, 2023

-

How to Get VA Loan Preapproval

Jul 03, 2023

-

See: How Does Trading in a Car Work?

Aug 08, 2022

-

How to Contribute to an IRA as a Gift

Aug 12, 2022

-

How to Start Renting Out Your House for the First Time

Jun 03, 2023