Jun 11, 2023 By Susan Kelly

Are you feeling frugality fatigue? Struggling to stay on budget and manage your finances but need help finding a way to make it work? Well, have no fear. We're here with helpful tips for living a more frugal life while keeping your sanity in check.

We will provide four key tips that will help you get started living frugally as well as overcoming any sense of "frazzle-dazzle" (or what we like to call "frugality fatigue). You don't have to sacrifice financial security for enjoyment. We'll show you how these two elements can work together harmoniously.

What Is Frugal Living

Frugal living is an approach to personal finance that focuses on making the most of what you have, reducing your expenses, and stretching your resources. It's all about cutting costs without sacrificing quality or fun. Many people are drawn to this lifestyle because it allows them to save money and build a financial cushion while still enjoying life.

Frugal Living Tips:

Create a Budget

Creating a budget for yourself is one of the biggest steps toward frugality. This will help you identify areas to cut back to save monthly money. Create an emergency fund so unexpected expenses stay within your savings goals.

Limit Impulse Buying

Another key tip to help you save money is to limit impulse buying. Before making any purchase, take time to think about whether or not it's something you need or want at the moment. This simple practice can help you avoid a lot of unnecessary expenditures and keep your budget on track.

Practice Mindful Spending

Once you have established a budget, try to be mindful of how much you spend on things. Pay attention to what triggers your spending habits and do your best not to give into

Shop Smart

Taking the time to compare prices and be mindful of when and where you're shopping can help you save money. Look for sales, coupons, and discounts to get the most bang for your buck. Buying items in bulk or using cashback apps can also provide additional savings.

Invest Wisely

Investing is another great way to build wealth while living frugally. However, it's important to research before investing to understand the risks involved and how to maximize returns on your investment dollars.

Learn To DIY

Learning a few DIY skills can provide big rewards when saving money on everyday expenses such as home repairs, car maintenance, and grocery shopping. Learning these skills will help you save money in the long run and can also be a great way to bond with family and friends.

Use Parks, Museums, and the Library for Entertainment

Finally, free or low-cost activities like visiting parks, checking out museums and art galleries, or borrowing books from the library can provide hours of entertainment without breaking the bank. These are all great ways to have fun as a family while still living frugally.

Use the Library

The library can be a great source of entertainment. They have books, magazines, and newspapers to read, and many libraries also host free events like lectures, movie nights, and art projects. You can borrow DVDs or rent a room for birthday parties or other gatherings.

How To Beat Frugality Fatigue:

Frugality fatigue is a natural part of any journey toward financial responsibility and security. It's easy to become discouraged when attempting big changes in your spending habits. Here are some tips for overcoming those moments of frazzle-dazzle:

Take Breaks

Taking breaks from frugal living is important for your mental health and well-being. Allow yourself time to enjoy experiences or buy small items that make you happy without breaking the bank. This will help you stay motivated and prevent frugality fatigue from setting in.

Find Joy In Simple Things

Trying to find joy in simple things like spending time with friends or walking outside instead of buying an expensive item can help keep your budget in check. It's also a great way to practice gratitude and appreciate the little things that make life more enjoyable.

Stay The Course

It can be difficult to stay the course with your frugal lifestyle, but it's important to remind yourself of your long-term goals and why you are making these changes. Remember, slow and steady wins the race regarding securing financial stability.

Focus on What You Already Have

Finally, focus on what you already have instead of what you don't. It's easy to get caught up in wanting the latest tech gadgets or designer clothing, but sometimes it's better to appreciate the items and experiences that you already own and enjoy.

Small Luxuries Fight Fatigue

Finally, allow yourself to indulge in small luxuries occasionally. Whether it's a massage or a movie night out with friends, allowing yourself to enjoy life and relax will help you stay motivated and on track with your frugal lifestyle.

Benefits of a Frugal Life

Save Money

The most obvious benefit of living a frugal lifestyle is the ability to save money. By cutting back on unnecessary expenses and shopping smarter, you can build up your savings quicker than you ever thought possible.

Financial Freedom

Living a frugal life also allows you to gain financial freedom by freeing yourself from debt and creating a cushion for emergencies or unexpected expenses. This can help provide peace of mind and prepare you for any challenges that come your way.

Stress-Free Lifestyle

A frugal lifestyle can also help reduce stress by removing the pressure of constantly buying things or keeping up with the latest trends. You'll have more time and energy to focus on other aspects of your life, such as relationships, careers, health, and hobbies.

Grow Your Savings

Living frugally can also help you grow your savings by investing in stocks, bonds, or other vehicles for long-term growth. This provides financial security and helps you build wealth over time.

FAQS

What are 2 examples of frugality?

Two examples of frugality are reducing unnecessary expenses and shopping smarter. You can save money without sacrificing your quality of life by cutting back on things like dining out, buying coffee every morning, or going to the movies frequently. Shopping smarter involves researching before purchasing and looking for coupons or sales to get the best deal possible.

Are frugal people happier?

Yes, studies have found that people who practice frugality tend to be happier than those who don't. This may be because they can achieve their financial goals faster and have more money in the bank. It can also lead to a greater sense of control over their finances, which often leads to feeling contentment and peace of mind.

Can a rich person be frugal?

Yes, a rich person can be frugal. While they may not need to worry about making ends meet every month, they can still practice smart spending habits such as avoiding impulse purchases and looking for opportunities to save money.

Conclusion

Frugal living can be a great tool for managing your finances and maximizing what you have. It provides security and comfort in knowing that you can always support yourself and is an excellent way to save money and invest in yourself or your dreams. It is important to remember that frugal fatigue is real, which is why it's so important to ensure that your goals are attainable and there are built-in rewards or incentives for making progress in reaching those financial goals.

-

Lenders for Mobile Home Financing

Jul 15, 2022

-

The inevitable trend of the development of things

May 24, 2021

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

Refinancing 101: Should You Refinance Your Student Loans?

Jun 14, 2023

-

Mortgage Review For Quicken Loans In 2023

May 25, 2023

-

Succeed by researching hard and thinking clearly

Jun 06, 2021

-

Best Places to Retire In Panama

Jun 30, 2023

-

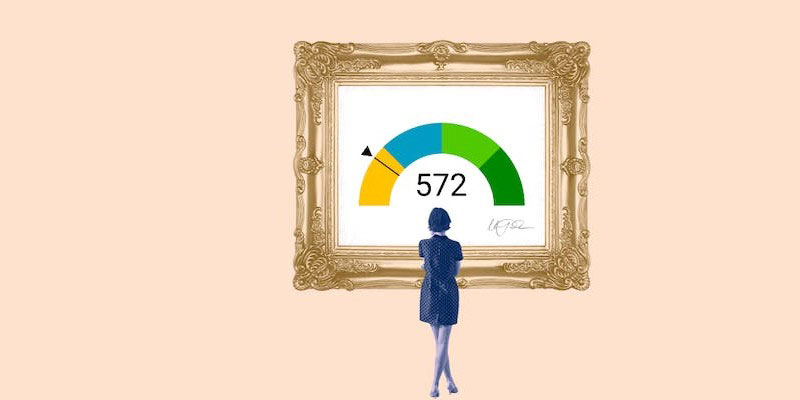

An Overview of 572 Credit Score

May 26, 2023