Jun 14, 2023 By Susan Kelly

Are you wondering if refinancing your student loans is your right decision? When making this decision, a good place to start is by understanding what a refinance means and how it could benefit you.

Student loan refinancing brings numerous advantages, including the potential to lower your interest rate, simplify payments with one lender, or even release cosigners from an existing loan.

To help make sure that this type of financial move makes sense and will benefit you in the long run, read on as we break down everything you need to know about refinancing student loans.

What is student loan refinancing, and who should consider it?

Student loan refinancing is swapping your current student loans with new loans from a different lender. You could be eligible for better rates and terms if you have good credit or a cosigner who does and a steady income.

If you're considering it, look into all available options for refinancing and shop around to get the best rate possible.

Should you refinance? What to consider first

Refinancing your student loans can be a great way to save money and secure more favorable terms, but it's important to ensure you understand what refinancing is and how it works.

Here are some points to consider before deciding if refinancing your student loan debt is the right choice for you:

- Savings: Does the refinancing offer a lower interest rate than your current loan? How does that affect the total cost of your loan, and how much money can you save over time?

- Length: How long is the repayment term on the new loan? Is it shorter or longer than your existing loan?

- Fees: Are there any fees associated with the refinance? Will you be charged an origination fee, a prepayment penalty, or other costs?

- Flexibility: Does the loan offer deferred payments, forbearance, and more options?

- Cosigners: Does the loan release or require cosigners?

- Repayment Plans: Is the repayment plan flexible enough to meet your needs? Are there multiple payment methods (i.e., automatic, online, mobile app)?

Pros and cons of student loan refinancing

Refinancing your student loan debt can have a lot of benefits, but it's important to understand the potential drawbacks as well. Here are some pros and cons of refinancing:

Pros

- Lower interest rate: Refinancing could significantly lower your interest rate and monthly payments. Depending on the loan, you could save thousands of dollars over the life of the loan.

- Simplify payments: Refinancing can help simplify payments by combining multiple loans into one monthly payment. You'll no longer have to keep track of due dates and amounts for each loan.

- Release cosigners or add them: Depending on the loan program, refinancing can either release cosigners from the loan or allow you to add a cosigner to increase your chances of approval.

Cons

- Loss of protections: Federal loans come with certain benefits and protections, such as deferment and forbearance, which may not be available with a private student loan.

- Penalties: Some lenders charge a prepayment penalty if you pay your loan off early, which can add to the total loan cost.

- Fees: Some lenders charge origination and processing fees, which can add to the cost of refinancing.

How to determine if a refinance is right for you?

Deciding if a student loan refinance is right for you involves considering several factors. The first factor you should consider is your current interest rate.

Look at the interest you currently pay on your loans and compare it to what other lenders offer. Refinancing could be a solid option if it provides a significantly lower rate.

Your credit score is another factor that must be factored into the decision-making process. Lenders may offer you lower rates if you have a good credit score.

But if your credit score is lower, it could mean higher rates or difficulty qualifying for refinancing.

Also, it's important to consider any fees accompanying the refinancing. Taking out a new loan means you'll likely have upfront fees.

These can include origination fees or other closing costs, so ask your lender about these charges before signing anything.

Lastly, take into account how long you plan to stay in repayment. If you plan on staying in repayment for the long term, refinance your student loans and lock in a lower rate to save you money over time.

The process of applying for a student loan refinance

Step 1: Gather Your Documents - To start, you'll need to gather the necessary documents so your lender can verify your identity and review your credit history.

This includes a copy of your driver's license or passport, pay stubs from recent months, tax returns for at least the last two years (or other income documentation if applicable), and a list of your current loans and other debts.

Step 2: Shop Around - Different lenders offer different rates, fees, repayment options, and other features, so it's important to shop around and compare offers before deciding. Given your situation, you'll want to find the lender with the best terms for you,

Step 3: Choose a Lender - Once you've identified the lender offering the best terms for your needs, it's time to submit your application. Your lender will review all the documents you provided in Step 1 and check if you qualify for a loan.

If everything looks good, they'll approve your loan and provide you with a loan agreement to review and sign.

Step 4: Finalize Your Loan - After signing your loan documents, the lender will disburse the funds into an account of your choosing. Once this happens, your old loans are paid off and replaced with the new refinanced loan.

Congratulations! You've just successfully refinanced your student loans.

FAQs

Why is it good to refinance student loans?

Refinancing student loans can be a great way to save money in the long run. Refinancing can reduce your interest rate and simplify payments with one lender (or even release cosigners from an existing loan).

What does it mean to refinance a loan?

Refinancing a loan involves a new loan with an updated interest rate and repayment terms. The new loan pays off the existing loans, allowing the borrower to acquire a better interest rate or other benefits, such as releasing cosigners from an existing loan.

Who is eligible for student loan refinancing?

Generally, lenders look for borrowers with a strong credit history, minimal debt-to-income ratio, and steady employment. However, the specific eligibility requirements vary by lender.

Conclusion

Refinancing your student loans is a big decision, and there are many factors to consider before moving. Weighing these options carefully will help determine if it makes sense for you and your financial situation.

Researching different lenders, comparing rates and terms, understanding eligibility requirements, and considering potential risks are all important steps in deciding if refinancing your student loans is right for you.

By researching and comparing different lenders, you can find the best deal that suits your needs and financial goals. With diligent research, understanding, and sound decision-making, refinancing can be a great tool to help save money or better manage debt over time.

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

How Do I Remove PMI On My Conventional Loan?

Jul 03, 2023

-

See How: Is It Possible to Retire at 45 With $500,000?

Jul 23, 2022

-

UnitedHealthcare Medicare Review

Feb 28, 2022

-

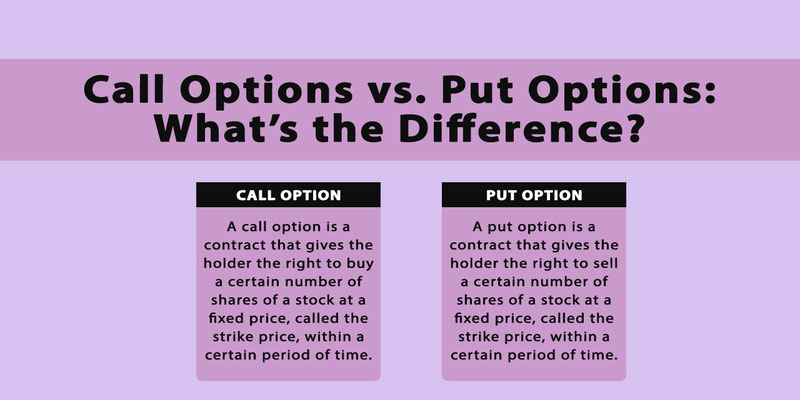

What is the Difference Between Call Option vs. Put Option

Jun 03, 2023

-

How to Contribute to an IRA as a Gift

Aug 12, 2022

-

Do You Know: What is a Direct Stock Purchase Plan?

Aug 06, 2022

-

Ways to Open a Savings Account

Feb 20, 2023