Jul 03, 2023 By Susan Kelly

As a homeowner with a conventional loan, you may be wondering how to remove Private Mortgage Insurance (PMI) and reduce your monthly expenses. This informative guide will walk you through the process of eliminating PMI on your conventional loan, helping you save money and achieve greater financial freedom. Read on to understand the ins and outs of PMI, when and how it can be removed, and the factors to consider during the removal process.

Understanding PMI and Its Purpose:

Explanation of PMI and its role in conventional loans:

Defining PMI and its purpose in protecting lenders against potential loan defaults.

Discussing the difference between PMI and other mortgage insurance types.

Factors that determine the requirement for PMI:

Exploring the loan-to-value (LTV) ratio and its significance in determining the need for PMI.

Understanding the impact of down payment and home equity on PMI requirements.

Purpose of PMI for lenders and borrowers:

Highlighting the benefits of PMI for lenders in reducing risk.

Discussing the potential advantages for borrowers in accessing homeownership with a lower down payment.

When Can PMI Be Removed on a Conventional Loan?

Loan-to-Value (LTV) ratio and its significance:

Defining the LTV ratio and its role in determining PMI removal.

Identifying the specific LTV ratio thresholds for PMI elimination.

Automatic termination of PMI:

- Explaining the conditions under which PMI is automatically removed.

- Clarifying the LTV ratio requirements for automatic termination.

- Time-based automatic termination:

- Discussing the time-based criteria for PMI removal.

- Outlining the specific timeline for automatic PMI termination.

Requesting PMI removal:

Providing step-by-step instructions for requesting PMI removal.

Highlighting the necessary documentation and requirements for a successful removal request.

Methods to Remove PMI on a Conventional Loan:

Paying down the loan to reach the required LTV ratio:

Explaining how making additional principal payments can accelerate PMI removal.

Discussing the potential impact of property value appreciation on LTV ratio reduction.

Refinancing the loan to eliminate PMI:

Evaluating the option of refinancing to remove PMI from the conventional loan.

Identifying the considerations for determining the cost-effectiveness of refinancing.

Factors to Consider When Removing PMI:

Impact of credit score on PMI removal:

Discussing the role of credit score in the PMI removal process.

Exploring strategies to improve creditworthiness for favorable PMI removal terms.

Property appraisal requirements:

Outlining the appraisal requirements for PMI removal.

Highlighting the importance of property value assessment.

Potential costs associated with PMI removal:

Appraisal fees:

- Discussing the potential costs involved in obtaining a property appraisal for PMI removal.

- Providing an estimate of appraisal fees.

- Closing costs for refinancing:

- Identifying potential closing costs associated with refinancing to eliminate PMI.

- Discussing ways to evaluate the cost-effectiveness of refinancing.

Conclusion:

Removing PMI on your conventional loan is an important step towards reducing your monthly expenses and building equity in your home. Understanding the intricacies of PMI, knowing when and how it can be removed, and considering the factors involved will empower you to make informed decisions. By paying down your loan or exploring the option of refinancing, you can achieve PMI removal and experience significant financial benefits. Take charge of your financial future and enjoy the savings that come with eliminating PMI.

FAQs:

What is the purpose of PMI in conventional loans?

The purpose of Private Mortgage Insurance (PMI) in conventional loans is to protect lenders in case borrowers default on their mortgage payments. PMI provides an extra layer of security for lenders by reimbursing them for a portion of the outstanding loan balance if the borrower fails to repay the loan.

When can PMI be removed on a conventional loan?

PMI can be removed on a conventional loan under certain conditions. There are two main ways PMI can be removed:

a. Automatic termination: PMI is automatically terminated when the loan-to-value (LTV) ratio reaches a specific threshold. This typically occurs when the outstanding loan balance is 78% of the original property value.

b. Requesting PMI removal: Borrowers can request PMI removal once their LTV ratio reaches 80% or lower. However, some lenders may have specific requirements, so it's important to check with your lender regarding their policies on PMI removal.

How does the loan-to-value (LTV) ratio affect PMI removal?

The loan-to-value (LTV) ratio plays a crucial role in PMI removal. The LTV ratio is calculated by dividing the loan amount by the appraised value of the property. As the borrower pays down the loan balance or the property appreciates in value, the LTV ratio decreases. When the LTV ratio reaches a specific threshold (typically 78% for automatic termination or 80% for requesting removal), borrowers become eligible to have PMI removed.

Can PMI be automatically terminated?

Yes, PMI can be automatically terminated on a conventional loan. Once the loan-to-value (LTV) ratio reaches the required threshold (usually 78% of the original property value), PMI is automatically terminated. However, it's important to note that this termination is based on the original property value and not the current appraised value.

What is the process for requesting PMI removal?

To request PMI removal, borrowers typically need to follow these steps:

a. Contact your mortgage lender: Reach out to your lender to inquire about their specific PMI removal requirements and procedures.

b. Gather necessary documentation: Lenders may require documentation such as proof of timely mortgage payments, evidence of property value, and an appraisal.

c. Submit a formal request: Prepare a written request to your lender, including the required documentation, to formally request PMI removal.

-

How to Contribute to an IRA as a Gift

Aug 12, 2022

-

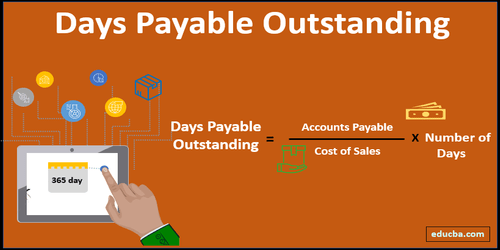

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

Tennessee Housing Development Agency Lenders

Jan 13, 2023

-

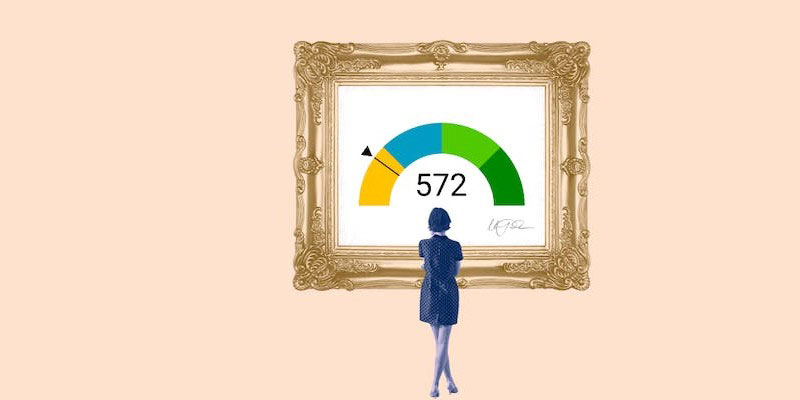

An Overview of 572 Credit Score

May 26, 2023

-

How Do Unsecured Loans Work?

Aug 26, 2022

-

A Complete Guide: The Returns of Short, Intermediate, and Long Term Bonds

Sep 10, 2022

-

See How: Is It Possible to Retire at 45 With $500,000?

Jul 23, 2022