Aug 08, 2022 By Susan Kelly

Introduction

What is day payable outstanding? Days Payable Outstanding (DPO) is a company's average time to settle unpaid bills from credit-purchased goods and services. The DPO measurement typically gauges the buyer's capacity for pressure tactics during negotiations for favorable terms with suppliers and vendors (e.g., price reductions, extensions of payment dates).

Days payable out (DPO) is a measure of financial performance that shows how long (in days) it takes a company to settle its bills and invoices with its trading creditors, including customers, suppliers, or lenders. The ratio gauges how successfully cash flow is managed and is often measured quarterly or annually. A company with more money in its DPO can pay its bills over a more extended period, allowing it to retain funds available for a more extended period and employ them more effectively to maximize benefits. A high DPO could be an early warning sign of failure to make prompt payments on debts.

Example

Furniture producer ABC Limited sources its raw materials from numerous vendors. His accounts payable balance sheet has a balance of Rs. 20,000,000. The company's cost of sales was Rs. 12,50,000. The DPO calculation looks like this: The DPO is as follows:

- [20,000,000/(82,50,000/365)] DPO = 88 days

This indicates that, on average, ABC Limited pays its bills 88 days after receiving them. Additionally, imagine that ABC Limited must pay its vendor Rs. 1,000,000 within 10 days and receive Rs. 1,000,000 in payment from clients within 5 days. This indicates that in five days, the corporation will own Rs. 100,000. The DPO is significantly impacted by several variables, including the nature of the firm, the level of market competition, and more.

Days Payable Outstanding Calculation

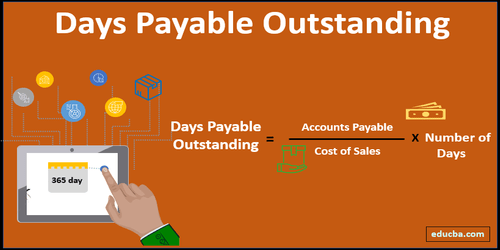

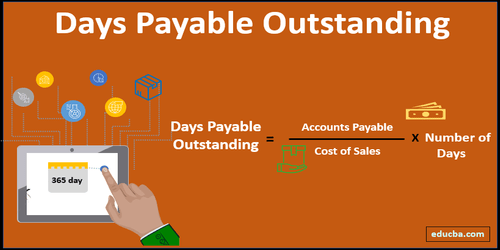

Divide the sales price by the number of days in the measuring period to determine the outstanding day of payment. The calculation commonly uses 365 or 90 calendar days as this number. By the final account payable balance, divide the outcome. The following is the formula:

- Accounts payable are closed (cost of sales/days) = Days due to payment

Finding days of unpaid invoices is the intended result. You can gauge how well your company's accounts payable department is performing by looking at the ratio of overdue days payable. Here are several explanations for how to determine how much of the day's due is yet unpaid. DPO should be compared to other businesses in its industry to determine whether it has been paying invoices excessively quickly or slowly. To evaluate its cash flow and create future estimates. To maintain a balance between the company's accounts payable and receivables so that there is enough money on hand to cover emergencies and keep your supplier happy.

The Value of Outstanding Payable Days

The number of days that unpaid receivables are outstanding is a significant efficiency ratio that gauges the typical time it takes for a business to pay its suppliers. This statistic is employed to examine the cash cycle. A corporation is impacted by a low or high DPO (in comparison to the industry standard) in several ways. For example, a high DPO may prompt suppliers to designate the business as a "bad client" and impose credit restrictions. The low DPO, however, can suggest that the company is not employing its cash reserves to their maximum potential and that operations should be improved.

A good number of days payable outstanding (DPO) is challenging to define because it depends on the industry, the company's competitive position, and its negotiating ability. For instance, Walmart is a sizable business in the retail industry. With such a vast market share, the retailer has the power to negotiate favorable terms with suppliers. The DPO of Walmart is currently 42 or so as of July 2017.

The Distinction Between DPO and DSO

A business's average time to pay off its debts is measured in days payable (DPO). However, the typical time frame for the sales to be paid back to the business is days sold outstanding (DSO). A high DSO indicates that the company is waiting longer to receive payment for items sold on credit. A high DPO can be interpreted in several ways, such as signaling that the company is utilizing its cash to build working capital or that its cash flow management is subpar.

Conclusion

Days payable out (DPO) establishes the typical time frame in which a company must settle its debts and expenses. Businesses with extraordinarily high DPOs can postpone payments, use the money to fund short-term projects, boost working capital, and improve liquidity. Higher DPO levels, while desirable, may not always be advantageous for the company because they may indicate a lack of cash and an inability to pay.

-

Best Appointment Scheduling Software for Small Business

Jun 16, 2023

-

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

Depository Trust Company

Aug 16, 2022

-

A Complete Guide: The Returns of Short, Intermediate, and Long Term Bonds

Sep 10, 2022

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

The inevitable trend of the development of things

May 24, 2021

-

Yield to Worst (YTW)

Sep 29, 2022

-

Tennessee Housing Development Agency Lenders

Jan 13, 2023