May 24, 2021 By Edward Weston

The focus of ordinary traders is only the final result: profit or loss. But they know nothing about how to operate, how to judge, why to operate in this way, and what theoretical basis supports such operation and judgment. Even some profitable traders can't give a very specific reason, so they have the theory of "market sense". Market sense really exists, but it doesn't equal irrationality. Personally, the market sense is a subjective embodiment of the inevitable law of the development of things.

Everything in the world has its inevitable law of existence and development. This law is universal, objective and eternal, and does not transfer by human will. But humans can change the world by understanding and using the law. There are also such rules in the futures market, which can explain why the trend in the futures market always has countless historical recurrences. Market sense is produced in this kind of historical recurrences. Although we may not remember every trend or fluctuation in the market, when the familiar trend appears, because we have experienced it many times, there is a stimulating conditioned reflex, which has a subtle impact on one's choice. When this kind of thing is summed up into one's trading mode, we call it experiences. Futures master is often someone with rich experiences and excellent market sense.

The best way to cultivate market sense and enrich experience is to go through a lot of practical training and make an in-depth analysis of each transaction.

-

Various forms of algorithm contracts

Oct 05, 2021

-

How to Buy a House with Multiple Owners?

Jul 01, 2023

-

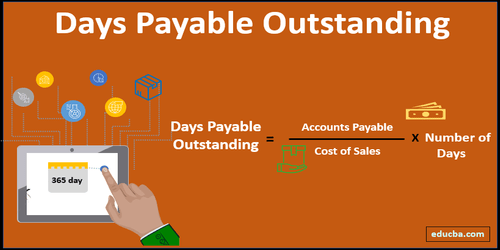

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

Lenders for Mobile Home Financing

Jul 15, 2022

-

All About Chargeback?

Aug 08, 2022

-

How to Buy a Foreclosed Property

Jul 03, 2023

-

Mortgage Review For Quicken Loans In 2023

May 25, 2023

-

A Quick Shot: What Is an Alien Insurer?

Aug 08, 2022