May 25, 2023 By Susan Kelly

As one of the most well-known mortgage lenders, quicken loans review mortgage is the subject of this year's Quicken Loans Review 2023. As of 2023, Quicken Loans has made a name for itself thanks to its streamlined interface, low-interest rates, and dedication to its clientele. In this analysis, we will examine the application procedure, mortgage options, rates, customer service, and web platform of Quicken Loans.

Quicken Loans distinguishes out because of the ease with which potential borrowers may complete their online application. A wide variety of mortgages, including those for first-time buyers, refinancers, and those needing jumbo loans, are available from this lender. Quicken Loans' goal is to give consumers attractive mortgage options at competitive rates, while actual rates will vary depending on several circumstances. quicken loans mortgage banker review has a dedicated team of mortgage experts available to help consumers at any stage of the loan process and who respond quickly to inquiries. The company's website has resources to help borrowers make educated decisions and improve their overall experience.

Application Process

Quicken Loans' straightforward digital mortgage platform cuts down on paperwork and time spent on the application process. Borrowers can take advantage of the company's expedited application process, allowing them to do so in their own time and from their homes. The online application simplifies the applicant's experience, which collects all necessary data and walks them through each stage. quicken loans mortgage banker review allows customers to upload their income and asset information straight from web sources to streamline the application process further.

Mortgage Options

Mortgage alternatives from Quicken Loans Mortgage cover a broad spectrum of customer requirements. Quicken Loans provides conventional loans, FHA loans, VA loans, and jumbo loans to borrowers buying a house for the first time or refinancing an existing mortgage. Borrowers will be able to discover a mortgage that works for their needs and goals thanks to the company's wide selection of options.

Competitive Rates

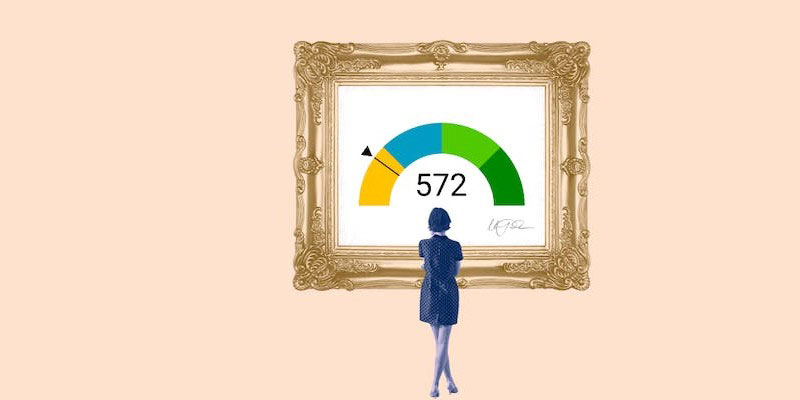

Quicken Loans provides them with low mortgage banker quicken loans review rates to attract and keep consumers. The corporation adjusts its interest rates regularly to market trends to give the borrowers competitive choices. Borrowers should be aware that interest rates are not permanently fixed and may change based on several criteria, including but not limited to credit history, loan type, and loan term. To get accurate quotes, contacting Quicken Loans or using their web resources is best.

Customer Service

Quicken Loans has a stellar reputation in the industry for its dedication to satisfying its customers. Borrowers can contact the company's staff in various ways, including via phone, email, and real-time chat. The mortgage experts at Quicken Loans are well-versed in the procedure and quick to respond to customer inquiries. Borrowers can also quickly and easily discover answers to frequently asked questions by browsing the company's extensive online information center.

Online Platform

The Quicken Loans website is remarkable because it is functional and straightforward. The user-friendly website allows borrowers to access their mortgage application and monitor its status conveniently. Borrowers can submit their required papers digitally through the platform, which includes a safe document upload feature. This time- and cost-saving feature allows you to submit documents digitally instead of physically. Furthermore, the Quicken Loans website provides many tools and calculators to assist borrowers in determining potential payments, contrasting available lending programs, and making educated choices.

Closing Process

For borrowers' convenience, Quicken Loans has streamlined the closing process. EClosing technology allows borrowers to review and sign loan documents electronically. This paperless method drastically shortens the closing process by eliminating the necessity for physical meetings. Quicken Loans also assigns each borrower a closing coordinator to answer questions and help with the closing process.

Pros and Cons

Quicken Loans have advantages and disadvantages, just like any other mortgage lender. Among the benefits are an accessible internet interface, numerous mortgage plans, and a focus on satisfying customers. However, there are some possible negatives, such as interest rates and costs may vary depending on a customer's specific situation, and there are no physical branch locations for customers who prefer face-to-face interactions.

Conclusion

Quicken Loans Mortgage is a market leader with a fast application process, affordable rates, exceptional customer service, and a powerful web platform. Quicken Loans mortgage process is quick and easy since the company prioritizes its customers and uses cutting-edge technology. Quicken Loans has a wide variety of mortgage programs to suit a wide variety of customers' needs, whether they are first-time buyers or are looking to refinance. However, prospective mortgagees should closely examine their own situations and compare mortgage rates and terms to choose the best mortgage option for them.

-

10 Financial Certifications to Advance Your Career

Jun 29, 2023

-

See How: Is It Possible to Retire at 45 With $500,000?

Jul 23, 2022

-

Is Stock Investing Profitable for You

Aug 03, 2022

-

Various forms of algorithm contracts

Oct 05, 2021

-

What are gold ETFs?

Jan 05, 2022

-

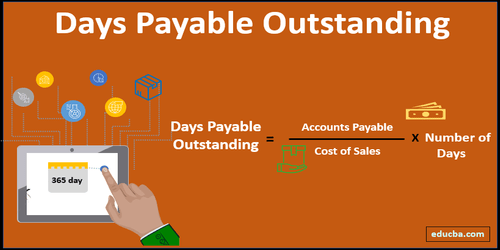

Learn About: What is Day Payable Outstanding?

Aug 08, 2022

-

How Often Do They Change My Credit Report?

Nov 12, 2022

-

A Quick Shot: What Is an Alien Insurer?

Aug 08, 2022