Sep 10, 2022 By Triston Martin

Introduction

Long-term bonds are susceptible to changes in interest rates. This is because bond investors purchase a portion of a company's debt when they purchase a corporate bond, for example, as this type of bond yields a fixed return rate to the investor. At the time of issuance, the principal amount, coupon payments, and maturity date are all clearly laid forth. Bonds and other fixed-income assets with maturities between two and ten years in the future are classified as medium-term (or intermediate) debt since bond and other fixed-income instrument classifications are typically based on maturity dates, which are the critical determinant of yield. Here you’ll learn about long term bonds.

Various Bond Fund Categories

Like traditional mutual funds, bond mutual funds enable investors to pool their capital to acquire a diversified portfolio of bonds and other financial instruments. You can build them to behave like bond indexes or other investment strategies and employ active or passive management styles. Bond mutual funds can invest in bonds of a single maturity or a wide variety of maturities, depending on investor preference. The fund's strategy can be preserved by buying more bonds or selling underperformers. A closed-end bond fund will only ever hold a set amount of bonds.

Even though these funds do rather well when bond markets are buoyant, their managers' access to leverage (investors borrowing money to acquire assets) also implies they might incur significant losses when markets turn negative. Bond ETFs, exchange-traded funds, allow investors to buy and sell bonds through the same trading platforms used for stocks. If you're familiar with bond unit investment trusts, you'll know that they work similarly to traditional bond investing in that bonds are kept in trust until maturity. When a bond in the fund matures, the proceeds are distributed to investors.

Money Market Mutual Funds

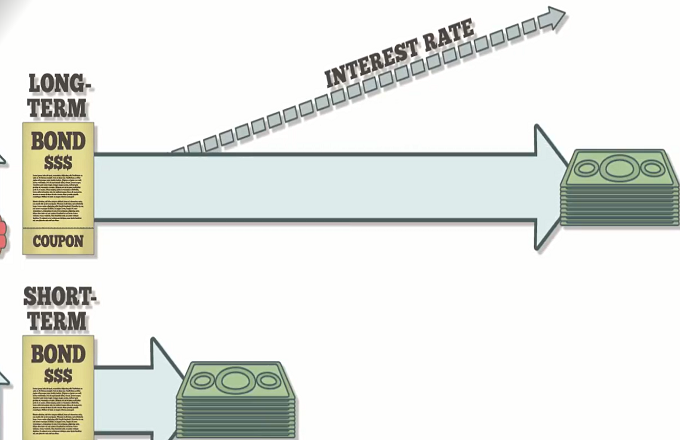

Bonds with more than a year of maturity are vulnerable to interest rate risk. The greater the range of possible price movements, the greater the time to maturity. When there is more time until maturity, there is less of a chance that the price will fluctuate significantly. Short-term bond funds often have lower yields and levels of risk. Furthermore, the performance of longer-term bonds is primarily governed by market forces, while short-term yields are influenced more by U.S. Federal Reserve policies. Since market sentiment tends to fluctuate more frequently than changes in Fed policy, long-term bond prices tend to be more volatile.

Bond Funds With Maturities Between Three And Five Years

Funds that invest in bonds over an intermediate period are, as their name suggests, in the middle of the risk and return distribution. Compared to short-term and long-term bond funds, intermediate-term bond funds are more common. For this reason, bond index funds and other funds that invest in various bonds are not a good option because the bond market tends to average to an "intermediate" maturity. Funds that fit this description differ from those that invest primarily in intermediate-term bonds and require great attention to detail.

Portfolios of Long-Term Bonds

Long-term bond funds often offer higher returns but also carry a more significant degree of uncertainty. The threat comes from interest rates, which are affected by inflation. The danger associated with fluctuating interest rates. Long-term bonds, as the name suggests, mature at a later time than their short-term counterparts. This lengthens the duration during which inflation and interest rate changes might affect the bond's price. These results demonstrate that total returns for longer-term bonds are higher when interest rates are falling, as they were at the end of a 31-year bond bull market. As interest rates rise, however, the relationship between the two changes.

Finding Your Best Option

Investors frequently move their portfolios to one side or another depending on their risk tolerance, goals, and time horizon. For this reason, investors who place a high value on safety may prefer short-term bonds despite their lower yield due to their excellent stability and lower loss possibility. Long-term bonds are a good option for investors willing to take on more risk in exchange for higher returns. There is no best course of action because it depends on the circumstances of each instance. Remember that you shouldn't need access to the principle of a long-term bond fund for at least three years.

Conclusion

Bond funds are a collective investment vehicle in which many individuals pool their resources to purchase bonds. If you anticipate a need for cash shortly, a short-term bond fund may be a good option. Debt instruments with maturities between two and ten years are intermediate or medium-term. If you can stomach the market's ups and downs and are patient, long-term bond funds are a great option. These fixed income assets' yields are often intermediate between short- and long-term obligations.

-

Various forms of algorithm contracts

Oct 05, 2021

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

Difference Between Cash-Out Refinance And Home Equity Loan

Jun 16, 2023

-

How to Start Renting Out Your House for the First Time

Jun 03, 2023

-

Taking the Necessary Steps to Prepare for Retirement

Jul 28, 2022

-

Mortgage Review For Quicken Loans In 2023

May 25, 2023

-

Are Solar Panels Expensive

Jul 04, 2023

-

Our Cash Offers More Advantageous to Sellers?

Mar 17, 2022