Feb 20, 2023 By Triston Martin

A savings account is a type of bank account that allows you to deposit money and earn interest on your balance. It is a safe and convenient way to save and grow your money, and it can help you reach your financial goals, whether you are saving for a down payment on a home, a special purchase, or simply building an emergency fund. This article will provide a step-by-step guide on how to open a savings account.

Step 1: Choose a Bank or Credit Union

The first step in opening a savings account is choosing a bank or credit union you would like to use. There are many options to choose from, including national banks, regional banks, online banks, and credit unions. Each type of institution has its benefits and drawbacks, so it is important to consider your specific needs and preferences when choosing. When choosing a bank or credit union, consider the following factors:

- Interest rates: Different banks offer different interest rates on their savings accounts. Higher interest rates can help you earn more money on your balance, so it is important to compare rates before making a decision.

- Fees: Some banks charge fees for savings accounts, such as monthly maintenance or minimum balance fees. It is important to review the fees associated with each account and choose an institution that offers a savings account that fits your budget.

- Convenience: Consider the location of the bank or credit union, the hours of operation, and the availability of ATMs and online banking services.

- Customer service: Look for a bank or credit union with a good reputation for customer service, as you may need to contact them with questions or issues in the future.

Step 2: Gather the Required Information

Once you have chosen a bank or credit union, you will need to gather some information to complete the application process. You will typically need the following information:

- Personal information: This may include your full name, date of birth, social security number, and current address.

- Employment information: You may need to provide information about your current job or source of income.

- Contact information: You will need to provide a phone number and email address for the bank to contact you.

- Initial deposit: You may need to make an initial deposit to open the account. The amount required may vary depending on the institution, so check beforehand.

Step 3: Complete the Application Process

Once you have gathered the required information, you can begin the application process. You can typically apply for a savings account online, by phone, or in person at a local branch. If you are applying online or by phone, you must provide the information required in step 2 and complete any necessary forms. If you are applying in person, you may need to bring documentation such as your driver’s license or passport to verify your identity.

Step 4: Fund Your Account

After your application has been approved, you will need to fund your account. This can be done by depositing or transferring funds from another account. Most banks and credit unions offer various options for funding your account, including online transfers, direct deposits, and automatic transfers.

Step 5: Review Your Account Information

After you have funded your account, it is important to review your account information to ensure everything is correct. This includes checking your balance, interest rate, and any fees that may be associated with your account. Reviewing the bank’s policies and procedures, such as withdrawal limits and account access, is also important.

Step 6: Start Using Your Account

Now that you have reviewed your account information and confirmed everything is correct, you can start using your savings account. Here are a few tips for making the most of your account:

- Set up automatic transfers: You can set up automatic transfers from your checking account to your savings account, making it easy to save a portion of your income each month.

- Consider a high-yield savings account: If you have a larger balance, consider a high-yield savings account, which offers a higher interest rate than a traditional one.

- Take advantage of online banking: Most banks and credit unions offer online banking, which allows you to access your account information, make transfers, and manage your account from anywhere.

- Monitor your account regularly: It is important to monitor your account to ensure your balance is growing and keep track of your spending.

- Consider a savings plan: If you are saving for a specific goal, consider creating a plan that outlines how much you need to save each month and when you hope to reach your goal.

-

What are gold ETFs?

Jan 05, 2022

-

All About Chargeback?

Aug 08, 2022

-

How To Get A Secured Business Loan

Jun 13, 2023

-

Best Appointment Scheduling Software for Small Business

Jun 16, 2023

-

Is It Good Or Bad To Have A Credit Score Of 811?

May 26, 2023

-

How to Start Renting Out Your House for the First Time

Jun 03, 2023

-

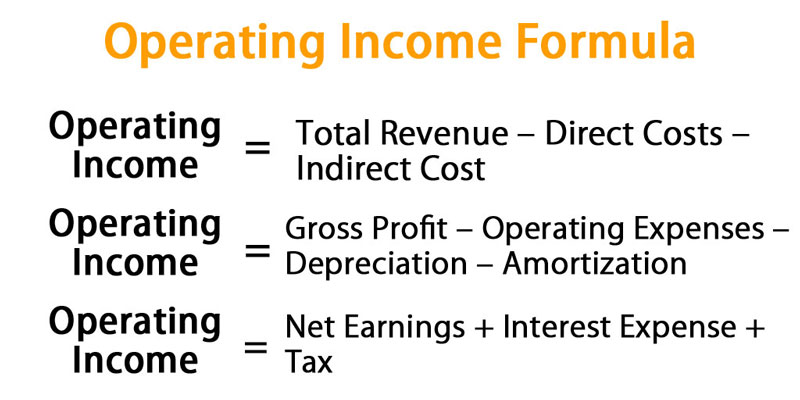

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

Various forms of algorithm contracts

Oct 05, 2021