Sep 09, 2022 By Susan Kelly

Values such as social, economic, as well as environmental outcomes are measured by social return on investment (SROI), a concept that has only just begun to make its way into the mainstream. They may gauge a company's contribution to society by looking at how it invests its money and other resources. SROI is used to analyze the general progress of particular advances, revealing the financial and social effect the organization may have, while a standard cost-benefit analysis is employed to compare various investments or initiatives.

How Social Return on Investment Works

To put it another way, SROI is helpful to businesses since it allows for more precise planning and assessment of their programs. And it may help the company articulate the value of its efforts and see the impact they're having on the community (internally and externally stakeholders). Social return on investment (SROI) is a tool that may be used by philanthropists, foundations, venture capitalists, and other non-profits to put a dollar amount on their social effect. There are challenges in trying to put a monetary value on the social benefit, but many approaches have been devised to assist get closer. One such technique that may be used to transform qualitative data into numerical values is the Analytical Hierarchy Process (AHP).

Influencing Factors of Social Return on Investment

Time

Multiple factors are affected by the passage of time on investments. The sooner you begin investing, the more time the power of compound interest has to work for you. The longer you wait to cash in, the more money compounding will eventually provide you. This is a major factor in why we advocate for investors to have a medium-to-long horizon. It's also important to remember that short-term market fluctuations may be fairly severe. Therefore, another benefit of investing for the long haul is that assets kept for longer periods of time tend to be less volatile than those maintained for shorter durations. Last but not least, you may have heard us mention that attempting to calculate when to join or quit the market is foolish since nobody has a crystal ball. Investing successfully relies on having a well-thought-out strategy and sticking to it.

Allocation of Assets

Whether or whether you invest in stocks, real estate, bonds, cash, and so on, and how much of your portfolio you should allocate to each are all important decisions that may have a major influence on your overall portfolio. After all, even if you hire the best stock picker in the world, your returns on investment would be negligible if you only allocate 10% of your capital to stocks. When constructing investment portfolios, we devote considerable thought to asset allocation since it is a key component in determining investment outcomes.

Stock Selection

Though "superstar" fund managers get much coverage, their influence on investor returns is minimal at best. While they may have a favorable effect on portfolio performance, their weight is much lighter than that of the other elements. Additionally, it is difficult to foresee out-performance when choosing stocks since previous results are not a guarantee of future results. There isn't much significance to the fact that one investment firm has done well in recent years alone. Choosing a fund manager based on previous performance is a poor criterion; instead, you should focus on the manager's philosophy and approach.

Investment Costs & Tax

Investment results are impacted by a number of variables, all of which need careful management. You should be certain that you are incurring as little tax liability as possible on your assets and that the fees and costs associated with those investments are reasonable. You should make sure that your money is well spent. When you contact us, we'll be pleased to discuss the fees associated with your assets and the many tax planning options available to you.

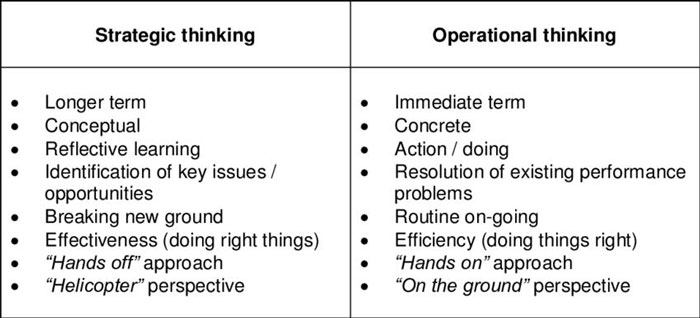

Basics of Strategic and Operational Thinking

Investment results are affected by the underlying company's strategic and operational foundations. Strategy is positioning a corporation to capitalize on opportunities and successfully react to competitive challenges. Cost control, entering untapped areas, and constant innovation are all part of operational execution that will help you remain ahead of the competition. In general, the stock price of a company will surpass market norms if its sales and profits are constantly in line with projections. On the other side, firms that lose market share and fail to meet profit estimates usually nearly underperform the market.

Conclusion

These are just a few of the variables that you may influence to improve your investment results. We will do all in our power to keep you oriented on the plan, the goals you've set out to attain, and the investing strategy you've developed to help you get there. This is the most effective strategy for maximizing returns while minimizing risk.

-

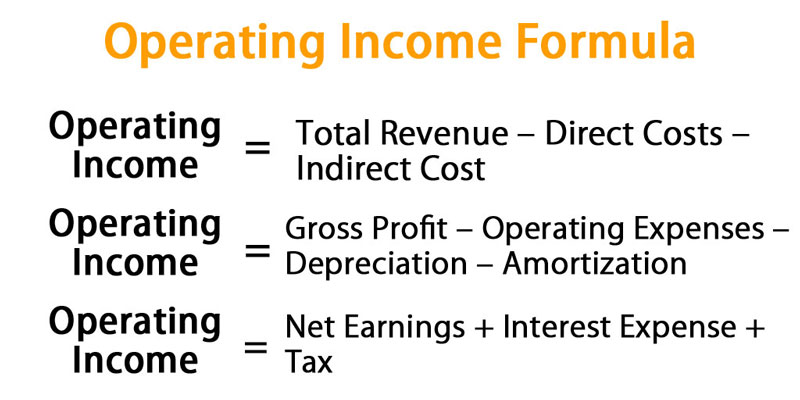

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

A Complete Guide: The Returns of Short, Intermediate, and Long Term Bonds

Sep 10, 2022

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

What is a Closing Disclosure

Jul 04, 2023

-

Ways to Open a Savings Account

Feb 20, 2023

-

All About Chargeback?

Aug 08, 2022

-

How Do I Remove PMI On My Conventional Loan?

Jul 03, 2023

-

The inevitable trend of the development of things

May 24, 2021