Jul 04, 2023 By Susan Kelly

Buying a house can be exciting and complex, but understanding the paperwork is essential. A Closing Disclosure is one of the important documents buyers, and sellers must complete when buying or selling a home. It includes all pertinent information regarding your loan terms, payments, closing costs, and other fees associated with your purchase.

Understanding how this document works will help both parties facilitate a smoother transaction by U.S federal laws surrounding real estate transactions. We will uncover what exactly goes into a Closing Disclosure and why it matters for anyone looking to buy or sell their home.

Closing Disclosure

A Closing Disclosure is a five-page document summarizing your loan terms and all associated fees. It includes details about your interest rate, monthly payments, closing costs, escrow accounts, and other payment amounts due at closing. This disclosure lists the estimated yearly taxes and insurance due on the property.

The buyer will receive a Closing Disclosure three days before their closing date. They should review it carefully to ensure all information is correct and no surprises appear during their final walkthrough or signing appointment.

The seller will also get a copy of this documentation but only needs to review it; however, they should still read over the document just in case something changes from what was originally offered when they accepted the purchase offer.

Buyers and sellers can ensure they get the agreed-upon terms when signing their contracts by reviewing and understanding the Closing Disclosure. It also helps them understand any additional expenses or costs due at closing that should have been accounted for in their budget.

Different Parts of the Disclosure

Loan Terms

This section includes the loan amount, interest rate, and type of loan you’ve received. It also details your estimated monthly payments and any prepayment penalties associated with the loan.

Closing Costs

The next section outlines the estimated closing costs due at closing, including title insurance, recording, appraisal, attorney, survey, etc.

Other Fees

Additional fees, such as homeowner association (HOA) dues or prepaid taxes, may be due at closing but not included in the initial purchase offer document.

Escrow Accounts

An account is federally mandated to cover annual expenses, such as taxes and insurance. This section will detail how much money needs to be placed into the escrow account to cover these payments for the upcoming year.

Cash To Close

This amount includes all the funds needed to close on the purchase of your home, including any out-of-pocket expenses or down payment you need to provide at closing.

Loan Costs

Here, you’ll find a breakdown of all fees associated with obtaining your loan, including points paid and origination fees.

Prepaids

The prepaid section outlines any additional costs due at closing that are not covered under the other sections of the disclosure, such as interest paid in advance or prepaid taxes.

Understanding what goes into a Closing Disclosure can help simplify the home-buying process and keep both parties informed of all costs associated with the transaction.

An accurate understanding of your loan terms and closing costs will prevent any surprises at closing. This document helps ensure you get the best deal on your new home and know all associated fees.

Benefits of a Closing Disclosure

Protects Buyers and Sellers

The Closing Disclosure is a disclosure document outlining all costs of purchasing a home. This helps protect buyers and sellers from any hidden fees or last-minute surprises at closing.

Ensures Accuracy

Accurate representation of loan terms and closing costs allows both parties to double-check any numbers toto ensure accuracy before closing.

Prevents Overcharges

Since lenders are legally required to disclose all fees associated with the loan, this prevents them from charging more than what was agreed upon between buyer and seller.

Clarifies Finances

By understanding your expenses upfront, you can plan out your financial obligations and ensure you have the funds necessary to close on the property.

Provides A Paper Trail

Having access to a formal record of loan terms, closing costs, and other fees associated with the purchase will help both parties keep track of all pertinent information related to their transaction.

Helps Avoid Delays

The Closing Disclosure must be provided three days before closing for the transaction to move forward without any delays. This helps ensure that all paperwork is complete and both parties are ready for signing day.

Promotes Transparency

Having an accurate disclosure document available allows transparency between the buyer, seller, and lender to prevent any surprises at closing. It also serves as a guide so everyone is aware of the costs associated with the transaction.

Educates Consumers

The Closing Disclosure educates buyers and sellers about their loan terms and other fees related to purchasing a property. It also helps them better understand what goes into buying or selling real estate, allowing them to decide when to sign on the dotted line.

Drawbacks of a Closing Disclosure

Confusing for First-Time Homebuyers

The Closing Disclosure can be difficult to understand for first-time homebuyers, as it contains much detailed information about fees and loan terms.

Potential for Errors

With so much information being transferred between parties, there is always the possibility that errors or inaccuracies could occur in the document.

Longer Closing Timeframes

Since the document must be provided three days before closing, this increases the overall time required to complete a sale which can delay a transaction and add cost to both buyers and sellers.

Inconvenience Factor

For those unfamiliar with the process, reading through and understanding all of the details of the Closing Disclosure can be an inconvenience.

No Room for Negotiation

Once the document is issued, buyers and sellers cannot negotiate loan terms or closing costs as this point has finalized them in the transaction.

Additional Costs

Since all fees must be reported on the Closing Disclosure, buyers may find themselves responsible for additional costs not initially accounted for before signing their contracts.

The Closing Disclosure serves a very important purpose when finalizing a home sale.

It provides both parties with detailed information regarding loan terms, closing costs, and other associated expenses so everyone is aware of what goes into the purchase or sale of real estate.

When to Expect a Closing Disclosure

The Closing Disclosure will be issued to you, the buyer, three days before closing. This is done for both parties to have ample time to review the information and prepare for signing day.

You must take your time going through the document and ensure that all fees are accurate and that there are no discrepancies with what was initially agreed upon between buyer and seller. If anything does not seem right or you need clarification on certain items, it is important to contact your lender immediately to resolve any issues before closing.

FAQS

Is the closing disclosure the last step?

Yes, the Closing Disclosure is typically the final step in the home-buying process and must be provided three days before closing.

What is the waiting period for closing disclosures?

The waiting period for closing disclosures is three days before closing. This allows both parties to double-check the details regarding loan terms and fees associated with the transaction to ensure accuracy.

What is the 3-day closing disclosure rule?

The 3-day closing disclosure rule states that the Closing Disclosure must be provided to buyers and sellers at least three business days before closing. This allows both parties ample time to review and understand all of the details related to their transaction.

Conclusion

A Closing Disclosure is an important part of purchasing a home and ensuring that you make the best decision for your financial future. By carefully reading your Closing Disclosure and taking the time to understand it, you can ensure that you are well-informed regarding the specifics of your mortgage transaction. If you have any questions or concerns about your Closing Disclosure, contact your lender before signing on the dotted line.

-

Refinancing 101: Should You Refinance Your Student Loans?

Jun 14, 2023

-

How to Start Renting Out Your House for the First Time

Jun 03, 2023

-

What Advantages Does A Term Deposit Offer: What You Should Take

Aug 09, 2022

-

Everything You Need to Learn About the Best Personal Finance Courses

Jul 13, 2022

-

Is It Good Or Bad To Have A Credit Score Of 811?

May 26, 2023

-

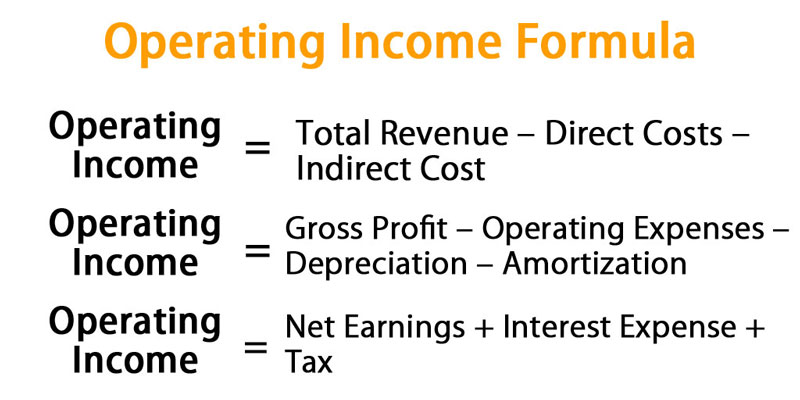

All You Need to Know About What Is Operating Income

Jul 28, 2022

-

How To Get A Secured Business Loan

Jun 13, 2023

-

Lenders for Mobile Home Financing

Jul 15, 2022