Aug 26, 2022 By Susan Kelly

Unsecured loans are loans that don't require any collateral. Lenders approve unsecured loans based on the borrower's creditworthiness rather than the collateralized assets. Unsecured loans include credit cards, personal loans, and student loans.

Accepting An Unsecured Loan

Unsecured loans are simply backed by the borrower's creditworthiness and lack any security, such as property or other assets.

Unsecured loans require higher credit ratings because secured loans are less risky for lenders to approve.

Credit cards, student loans, and personal loans are unsecured loans.

If a borrower fails on an unsecured loan, the lender may sue the borrower or work with a collection agency to get the money back.

Depending on the borrower's creditworthiness, lenders may choose to approve or reject an unsecured loan; nevertheless, regulations protect borrowers against dishonest lending practices.

Operation Of Unsecured Loans

Unsecured loans are approved without utilizing real estate or other assets as security and are also known as signature loans or personal loans. These loans usually include approval and reception requirements based on the borrower's credit score. Many applicants seeking unsecured loans must have good credit to be accepted.

A secured loan differs from an unsecured loan in that the borrower pledges a specific asset as collateral for the loan. The pledged assets increase the lender's "security" for issuing the loan. Two instances of secured loans are mortgages and vehicle loans.

Some lenders will let loan applicants with bad credit offer a cosigner because unsecured loans require higher credit ratings than secured loans. If the borrower defaults on the loan, the cosigner agrees to assume responsibility for the debt. This happens when a borrower fails to make principal and interest payments on a loan. Due to the absence of security, unsecured loans pose a greater risk to lenders. Therefore, the interest rates on these loans are typically higher.

Furthermore, if the borrower owns a home, a lien may be placed on it, or the loan may otherwise be due. Defaulting borrowers may have unfavorable consequences, including lower credit scores.

Types Of Unsecured Loans

Unsecured loans include but are not limited to personal loans, student loans, and most credit cards, all of which can be either revolving or term loans.

A revolving loan has an available credit limit that can be used, paid back, and then used again.

On the other hand, a term loan must be paid back in equal monthly installments until the loan is fully repaid at the end of the term. Even though these loans are typically related to secured loans, there are also unsecured term loans. Unsecured term loans include credit card debt consolidation loans and bank signature loans.

The market for unsecured loans has recently expanded, partly due to fintech (short for financial technology firms). For instance, peer-to-peer (P2P) finance has grown over the past ten years, thanks to online and mobile lenders.

Unsecured Loans Versus Payday Loans

Alternative lenders, including payday lenders or companies that offer merchant cash advances, don't offer secured loans in the traditional sense. They do not have tangible assets to support their loans, in contrast to mortgages and auto loans. However, these lenders go above and above to ensure repayment.

For instance, payday lenders could require the borrower to provide a postdated check or allow an automated deduction from the borrower's checking account to repay the loan. The borrower must pay back a set percentage of online sales via a payment processing service like PayPal, as is common practice among many online merchant cash advance lenders. These loans are regarded as unsecured even though they are partially secured.

Specific Considerations

Although creditworthiness may factor in a lender's decision to approve or reject an unsecured loan, regulations protect borrowers from predatory lending practices. The Equal Credit Opportunity Act (ECOA), for example, made it illegal for lenders to base loan terms or any other aspect of a credit transaction on a borrower's race, color, sex, or religion after it was passed in 1974.

Even though loan practices have been more equitable over time in the US, discrimination still occurs. The Consumer Financial Protection Bureau (CFPB), which is in charge of monitoring compliance and implementing the ECOA, issued a Request for Information in July 2020 to investigate ways to strengthen the ECOA's efforts to ensure nondiscriminatory access to credit. Clear regulations protect African Americans and other minorities. Still, the CFPB must support them with action to ensure that lenders and other parties uphold the law, according to Kathleen L. Kraninger, director of the CFPB.

-

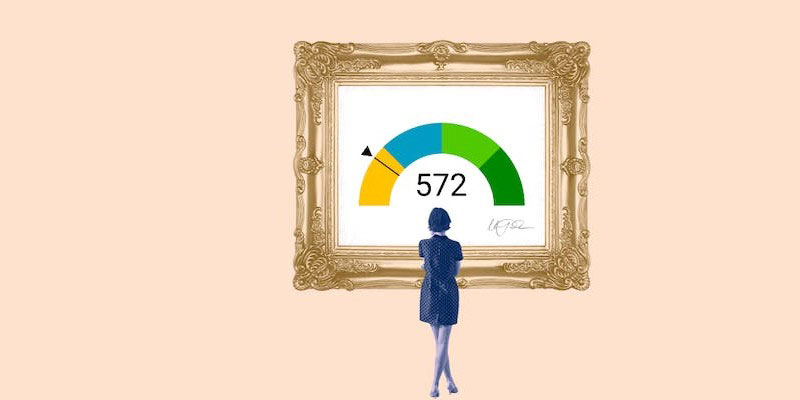

An Overview of 572 Credit Score

May 26, 2023

-

How to Get VA Loan Preapproval

Jul 03, 2023

-

Best Places to Retire In Panama

Jun 30, 2023

-

Best Appointment Scheduling Software for Small Business

Jun 16, 2023

-

What Is an Overdraft?

Aug 07, 2022

-

Frugal Living Tips Plus How to Beat Frugality Fatigue

Jun 11, 2023

-

See How: Is It Possible to Retire at 45 With $500,000?

Jul 23, 2022

-

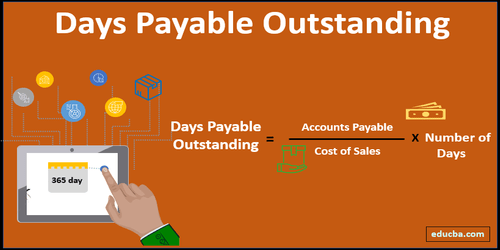

Learn About: What is Day Payable Outstanding?

Aug 08, 2022